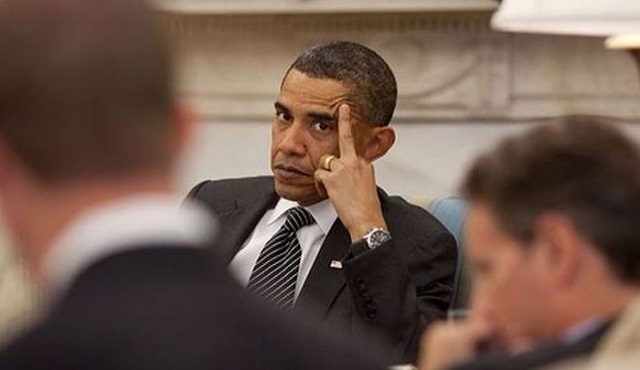

Obama’s Financial Legacy – A Shift from Bank Bailouts to Bail-Ins

By Amil Imani

Bail-ins, they say, are like financial gymnastics gone wild – saving failing banks with the equivalent of a fiscal somersault.

According to Fortune magazine:

A bail-in is a form of financial relief for banks that are in danger of collapsing or going bankrupt. The relief comes from canceling some or all of the bank’s debt by reducing the value of bank shares, bonds, and uninsured deposits. (Note: The Federal Deposit Insurance Corporation (FDIC) insures most bank deposits up to $250,000 per individual.)

A bail-in is the opposite of a bailout. Instead of relief funds coming from outside (taxpayers), the funds come from inside (shareholders and depositors). Although bail-in relief has been implemented in Europe, it has never been used in the U.S.

Even so, bail-in relief was legalized in the U.S. with passage of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, following the 2007–2008 financial crisis in which banks deemed “too big to fail” were bailed out by the U.S. government. The specific section of Dodd-Frank that deals with bail-ins is Title II: Orderly Liquidation Authority (OLA).

It’s the anti-bailout, where instead of Uncle Sam swooping in with taxpayers’ cash, they tap into your wallet. Picture this: the bank’s equity gets trashed, and debts? They’re tossed into the financial blender, ready to absorb losses. What’s left? If you will, a bank trying to rise from the ashes, debtholders turning into equity holders, a financial phoenix.

Depositors, brace yourselves because a bail-in isn’t just a banking term for the elite. Your deposits might get a haircut – a trim that leaves you with less green. It’s like a cash version of a bad haircut; only you pay for it. Debt into equity, they say. So, if you had a loan, part of it might morph into a share in the bank. Congratulations, you’re a shareholder now. Dividends, risks, the whole shareholder shindig – welcome to the rollercoaster.

Oh, but there’s a VIP section in the world of deposits – a priority ranking. Some deposits get a golden ticket, a front-row seat in the insolvency show. If the bank goes belly-up, these priority deposits might have a better chance of survival. It’s like a financial Hunger Games, where your deposit category decides if you’ll survive.

And then there’s the tax twist. Bail-ins come with tax consequences, a fiscal aftershock. The government’s got its magnifying glass out, looking at how it affects shareholders and creditors. It’s like a financial detective story, trying to figure out if the tax system is playing favorites or just playing fair.

Now, rewind to the U.K., where Northern Rock pulled a spectacular bail-in move. A bank turned building society turned bank again; it danced on the edge during the 2008 financial crisis. The U.K. government swooped in, not with a bailout, but a bail-in. Debts to equity, customers turned shareholders – a financial plot twist.

So, here’s the burning question: How do you dodge the financial thunderstorms of a bail-in? Step one: decode the bail-in process. Know the drill because you’ll want to know how to stay afloat when the financial flood comes. Keep an eye on your bank’s health – financial checkups are crucial. Spot red flags, like a nosedive in assets or a debt rise. It’s like monitoring your bank’s vital signs; a healthy bank keeps the financial doctor away today.

Deposit insurance is like a financial superhero cape. In the UK, the FSCS rides to the rescue, covering deposits up to £85,000. It’s like a financial safety net, ready to catch you if your bank takes a leap off the fiscal cliff. Diversify, they say. Spread your financial wings across stocks, bonds, and real estate – a financial buffet to avoid putting all your eggs in one risky basket.

Consider this: if your bank’s on shaky ground, they might offer you a golden ticket to convert your debt into equity. It’s like a backstage pass to the financial show, but beware – being a shareholder isn’t all glitz and glamor. Risks, dividends, and the financial roller coaster are part of the deal.

Stay informed, they say. Know the financial rules of the game in your country. It’s like a financial playbook; knowing the rules helps you navigate the financial field. But remember, even with all these steps, there are no guarantees. Consulting a financial wizard might be your best bet when the financial storm hits.

And now, the origin story: the Dodd-Frank Act of 2010. A financial superhero born out of the 2008 financial crisis. It banned bank bailouts, opening the door to bail-ins. No more taxpayers’ cash rescues; instead, banks tap into the pockets of depositors and bondholders. It’s a financial power shift, a change in the financial rescue script. A shift from Uncle Sam’s wallet to yours because it’s survival of the financial fittest in the financial world. This monumental legislation, a brainchild of the Obama administration, marked a turning point in financial history, aiming to prevent a repeat of the financial calamities that led to the “Too Big To Fail” bailouts.

Thanks a lot, Obama.

©2023. Amil Imani. All rights reserved.

This article is courtesy of DrRichSwier.com, an online community of citizen journalists, academics, subject matter experts, and activists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit DrRichSwier.com for more great content.