Biden Economics: Natural Gas Soars 700%

By The Geller Report

“Best economy in history.” — White House

Natural Gas Soars 700%, Becoming Driving Force in the New Cold War

(Bloomberg) — One morning in early June, a fire broke out at an obscure facility in Texas that takes natural gas from US shale basins, chills it into a liquid and ships it overseas. It was extinguished in 40 minutes or so. No one was injured.

It sounds like a story for the local press, at most — except that more than three weeks later, financial and political shockwaves are still reverberating across Europe, Asia and beyond.

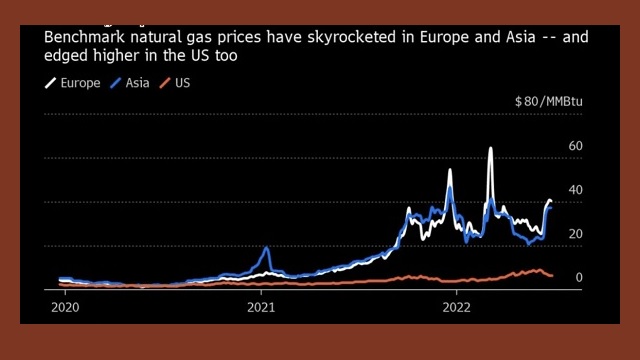

That’s because natural gas is the hottest commodity in the world right now. It’s a key driver of global inflation, posting price jumps that are extreme even by the standards of today’s turbulent markets — some 700% in Europe since the start of last year, pushing the continent to the brink of recession. It’s at the heart of a dawning era of confrontation between the great powers, one so intense that in capitals across the West, plans to fight climate change are getting relegated to the back-burner.

In short, natural gas now rivals oil as the fuel that shapes geopolitics. And there isn’t enough of it to go around.

It’s the war in Ukraine that catalyzed the gas crisis to a new level, by taking out a crucial chunk of supply. Russia is cutting back on pipeline deliveries to Europe — which says it wants to stop buying from Moscow anyway, if not quite yet. The scramble to fill that gap is turning into a worldwide stampede, as countries race to secure scarce cargoes of liquefied natural gas ahead of the northern-hemisphere winter.

The New Oil?

Germany says gas shortfalls could trigger a Lehman Brothers-like collapse, as Europe’s economic powerhouse faces the unprecedented prospect of businesses and consumers running out of power. The main Nord Stream pipeline that carries Russian gas to Germany is due to shut down on July 11 for ten days of maintenance, and there’s growing fear that Moscow may not reopen it. Group of Seven leaders are seeking ways to curb Russia’s gas earnings, which help finance the invasion of Ukraine — and backing new LNG investments. And poorer countries

that built energy systems around cheap gas are now struggling to afford it.

“This is the 1970s for natural gas,” says Kevin Book, managing director at ClearView Energy Partners LLC, a Washington-based research firm. “The world is now thinking about gas as it once thought about oil, and the essential role that gas plays in modern economies and the need for secure and diverse supply have become very visible.”

Natural gas used to be a sleepy commodity that changed hands in fragmented regional markets. Now, even though globalization appears to be in retreat across much of the world economy, the gas trade is headed in the opposite direction. It’s globalizing fast — but maybe not fast enough.

Keep reading……

AUTHOR

Pamela Geller

RELATED ARTICLE: EU Declares Fossil Fuel To Be ‘Green’ Energy As ‘Climate Change’ Narrative Self-Destructs

EDITORS NOTE: This Geller Report column is republished with permission. ©All rights reserved.

This article is courtesy of DrRichSwier.com, an online community of citizen journalists, academics, subject matter experts, and activists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit DrRichSwier.com for more great content.