Positive Feedback Loops With Negative Consequences – Part 2

By Neland Nobel

Editors Note: Janet Yellen, US Secretary of the Treasury said late last week that the US would be out of money by January 19th, and would begin to take extraordinary measures to keep the government afloat until June. The problem is the previous Congress has already approved massive spending but has to go back to the new Congress once again to approve an increase in the debt ceiling. That approval simply gives the US government the authority to borrow more money from new investors so that it can pay the old investors. It is just rolling the debt forward and borrowing additional funds as needed. Markets seem to have taken the problem calmly so far and believe most of the debate is political theatre. As in the past, after some noise, the debt ceiling will be approved, or so it is thought. We hope such views are wrong. Some will call balking at raising the debt ceiling irresponsible and childish. Actually, running up $31 Trillion dollars worth of debt when Baby Boomers are hitting Social Security and Medicare is what is childish and irresponsible. Stopping the country from driving off a fiscal and monetary cliff is less childish than going over the cliff. The combination of a 30% increase in discretionary spending, increased need for defense spending, increased interest costs, and the aforementioned demographically sensitive entitlements, are all driving the US like Thelma and Louise at the movie’s end. Somebody needs to take the wheel and jam on the brakes. We hope the change in House rules, a new Speaker with a spine, will get real spending concessions from the Democrats. Remember as well as we saw with the speakership battle, in a closely divided Congress, a relatively small group of dedicated Congressmen can extract meaningful concessions. This is absolutely necessary for the good of the country. However, the political battle has the potential to rattle markets. In 2011, it caused some market spasms and lead one rating service to downgrade the creditworthiness of the US. At the end of the day, if we cannot get control of spending, we are all headed for a fiscal crisis anyway. In 2011, it did little to stop wild spending. We have to do a lot better this time despite the risk to the markets.

There is one other cycle of importance, that operates somewhat independently of these other trends. That is demographics.

Demographics for much of the past 20 years was a force restraining inflation, but now is shifting towards aggravating inflation. The dependency ratio, that is the percentage of people who live off government benefits is rising rapidly while the number of workers to support this teetering regime is falling. The number of “dependents” on government spending includes both the rapid increase in the elderly who leave the workforce and the rapid rise of people on disability. It is odd as we have moved away from dangerous industrial jobs and to safe office jobs that disability claims should be soaring. It is a combination of liberalization of definitions of disability, poor diet, and drug abuse. In addition, we have almost a third of prime working-age men leaving the workforce. Generous benefits plus the expansion of Medicaid help subsidize their absence. This drop in the workforce not only is expensive for those who do work, but it also tends to force up wage rates aggravating inflationary pressures in the labor market.

In Western welfare states, the bulk of government benefits is triggered by age. For medical benefits, age 65 for Medicare. For Social Security, typically around 66 or so in the US.

The baby boom was not linear but had its own internal booms and busts. The Baby Boom is typically measured from 1946 to 1964. On average, about 4.2 million births per year. But you know the old adage about averages. The man’s head was in the oven and his feet were in the freezer, but on average, he was comfortable.

The biggest part of the Baby Boom was from 1957 to 1961. Then it started to tail off about by 1965. Births then dropped about 25% and have now fallen below replacement levels of 2.1 children per family.

Assuming age 66 means full Medicare and Social Security benefits for most people, add 66 to 1957. That takes you to 2023. That means starting right now and continuing for the next seven years, an enormous number of Baby Boomers will qualify for benefits, driving up Social Security and Medicare spending. The next few years will see the biggest burden ever placed on the system.

This has been known for some time, but no preparations were made for this enormous increase in expenditures. Instead, Democrats with the help of RINO Republicans spent as if these burdens did not exist.

Now all the bills are coming due at the same time, putting enormous pressure on spending, and making it very difficult not to run enormous deficits. And remember, deficits have to be financed in some way: borrowing, inflating, or higher taxation.

Social Security has gone into negative cash flow (that means SS taxes collected are not enough to pay benefits), which then forces the system to “sell” nonmarketable treasury bonds which make up the reserves of the system. Without getting too far into the technical weeds, that means the unfunded debt now becomes a funded debt. We will have to borrow and tax additionally going forward to keep paying benefits.

However, the higher the inflation, the more spent on Social Security due to cost-of-living adjustments, another perverse feedback loop.

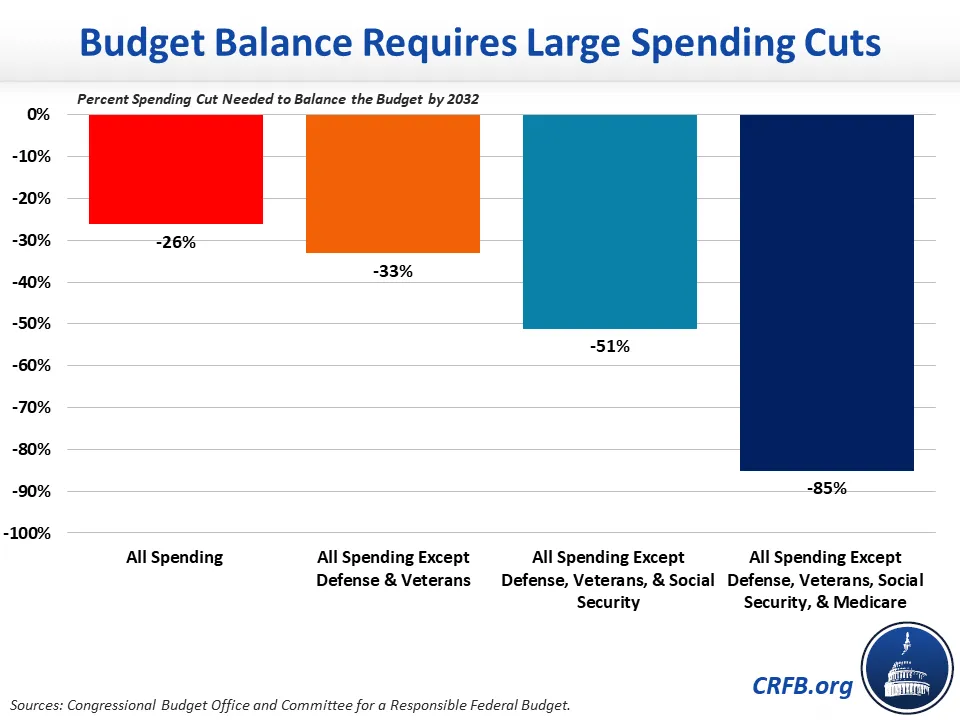

As indicated, driving many of these feedback loops is the towering deficit, the need to finance it, and the political difficulty of balancing the budget. The Committee For a Responsible Federal Budget recently put out this chart, which must be studied to be truly appreciated.

Because so much spending is now “baked in the cake”, it would require a cut of 85% in the portion of the budget not in the cake, to bring the budget into balance. It would require a 26% cut in all spending in the cake and out of the cake, to get to balance.

How could such cuts be made if Congress can’t even have the guts to cut funding for NPR, which is already lavishly supported by super-rich liberal foundations? If we can’t find the nerve to cut something as frivolous and redundant as NPR, how could we ever possibly find the political nerve to cut Social Security benefits?

Added to all these trends of increased spending, rising rates, and inflationary feedback loops, wars are always expensive and cost more and last longer than anyone thinks. Having ended abruptly the War in Afghanistan, our leaders immediately got us involved in a war with Russia via Ukraine. Rearming and reshoring our defense supply chains from China will also be expensive.

Most estimates suggest total aid and military operations for Afghanistan came to a tad over $2 trillion dollars. For a 20-year war, that is around $100 billion a year, on average.

According to the Center for Strategic and International Studies, the US alone has spent $68 billion and has proposed an additional $37 billion for Ukraine. That’s over $100 billion and does not include support from the rest of the world. Moreover, it does not include the cost of distortions in food and energy markets created by sanctions, which have tripled the cost of electricity in Europe and the cost of food and energy worldwide.

We have no idea what the final costs will be but you can be sure it will be more than anyone thinks it will be. Some of these costs are direct, but many are indirect.

Usually, war creates a necessity to ration existing resources and expand resources as quickly as possible. But in our era, we have another cycle working, the extreme environmental movement. It seeks to achieve zero carbon emissions, starving existing energy resources and driving up the cost of food and fuel, just as central banks battle to fund the Ukraine war, rearmament to face China, demographic time bombs, and years of previous reckless spending.

Environmentalism is now embracing “no growth”, and “no babies, which makes all the negative financial and demographic trends mentioned earlier even worse.

How can you support a huge and growing worldwide debt bubble without economic growth and increased revenue to service the debt? How can all the future obligations we are piling up be paid for by a diminishing number of babies? This is not a good time to become a no-growth fanatic!

Rarely have so many feedback loops with negative consequences come together in the same time period, each with its own intersecting feedback loops.

Rising debt can be dealt with only in three ways. You can pay the debt down, you can roll the debt forward and pay increased interest, or you can default on that debt. All alternatives except default need rising income streams (economic growth), but that is now being strangled by progressive over-regulation and environmentalism.

Government among all institutions has wiggle room in the default option. That one is the depreciation of the value of money (inflation), which can be regarded as a slow-motion default. But make no mistake. It is a form of default.

Because it spreads misery over time and the population, inflation of the currency has been the historic “solution” to government funding problems. However, it really is not much of a solution. It creates class conflict, and radical politics, and has often resulted in war. It all pivots on how severe the inflation is and the strength of the social fabric and institutions of the afflicted nation.

But given where we are, inflation may not be option planners think it will be. Many government benefits are now indexed to inflation, a great way to drive spending higher. Burst the asset bubble and you now have additional costs to rescue banks and other institutions and key industries.

Once the debt bubble reaches a certain size (and we have reached that size), inflation-induced rising interest rates cause asset prices to fall and the economy to slow, impairing revenue streams, triggering defaults, and requiring bailouts. Both in the busts around 2000 and then in 2008, deflation became a serious problem. Defaults in housing (the private debt bubble) wrecked the economy and the banking system, which in turn caused a huge rise in expenditures for bailouts of banks, autos, pensions, airlines, and state governments.

As a further complication, the US is the center of the international financial system and a net huge borrower with a massive deficit in our balance of trade. The dollar is the reserve currency of the world and the currency to settle oil payments. If inflation is let out of hand, the world may well abandon the dollar as it is not a reliable reserve asset.

And what good is there holding bank reserves in dollars if the US government can seize them at any time, with no judicial process whatsoever?

We are already seeing hints of that with central banks buying more gold in 2022 than any year since the breakdown of the international monetary arrangements with the collapse of Bretton Woods in 1971.

Further aggravating the problem, the US has militarized the international monetary system by seizing Russian bank reserves and forcing them out of the international payments system (the SWIFT payments system).

Other countries such as Saudi Arabia, India, Brazil, and especially China, have taken note of the hazard of getting crosswise with the US. It could happen to them next. This quite naturally sets in motion a desire to seek better alternatives and not be subservient to the US. In other words, we have shown the big international buyers of our debt that they are fools to fund us in the future.

Those who militarize money can only expect others to retaliate in kind. That risks the US losing its “exorbitant privilege” of being able to issue the reserve currency. We remain the only country that can “pay” for both internal and external debt by printing money. We lose that subsidy and it will quickly become a very expensive world for us.

How all this works out is difficult to know. It is not clear that inflation can work as a policy choice because of the dangerous trends that decision self-actuates. Inflation can’t reduce the debt burden when its very existence is adding to debt at the same time. What investors need to appreciate is that the “long-term problem” of debt and deficits is now coming due. The future is becoming the present.

There will be some combination of inflation, recession, default, or expensive and crushing debt service. You can’t waive the debt away. One man’s debt is another man’s asset. You can’t get one man out of a burden without imposing it on another.

That is the price you pay for short-sighted and stupid financing decisions. Political leaders run on a 2 to the 4-year political cycle, so they have had the incentive to get the political benefit of big spending today and defer the cost to the ether of the future. They worry about the next election and don’t make decisions for a stable future. Let the kids pay for all the benefits. Just get me elected today. That works for a while until there are too few kids to pay the bills, or they wake up. It has been a very successful game of kicking the can down the road.

The problem is, we are rapidly running out of road. We are all about to get kicked in the can really hard.

We say this because most of these feedback loops are now self-sustaining and almost immune from normal politics.

If demographics are not destiny, it is about as close as you can get.

Even if wisdom and political will could be found, you can’t pass legislation stopping compound interest. You can’t pass a bill to stop people from aging. And, there is no legislation you can pass to stop the business and credit cycle.

From both a political and investment standpoint, the next several years will likely prove to be turbulent and difficult to deal with. There is simply no way of getting out of this without pain. The huge spending by Democrats in the past few years has likely put any kind of easy solution out of reach.

Trends had already bought us to the edge of the cliff but this latest burst of sheer irresponsible budgetary excess has pushed us over the edge.

Thus, the consequences of these feedback loops are to put us between the alternatives of inflation and deflation, both very serious outcomes that can wreck society and political stability. Financial crises seem to be coming closer and closer together. We are already working on the third one since the turn of the century.

Inflation or deflation? Boom and bust. As suggested, how this works out depends on the strength of institutions and social cohesion when these things occur. How would you rate social cohesion, institutional trust, and confidence in our government at this time?

This article is courtesy of ThePricklyPear.org, an online voice for citizen journalists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit ThePricklyPear.org for more great content.