I would like to discuss some of the illegalities that occurred in the 2020 election and the proposed constitutional remedies that we thought we could advance.

I would also like to discuss the lawfare that is sweeping across the country and destroying not just the people that were involved in those efforts, but the very notion of our adversarial system of justice.

This fight and the dangers from it are much bigger than what I am dealing with personally, or what the hundred or so Trump lawyers who have been targeted in this new lawfare effort are dealing with. It seems that there is something similar going on here, albeit to a much less lethal degree, than what we are seeing with the October 7th attack on Israel, as that, too, was an attack on the rule of law.

The international community that will condemn Israel’s just response to these unjust attacks demonstrates a bias in the application of the rule of law that is very similar to what we are dealing with here.

These are not isolated instances. They go to the root of the rejection of the rule of law. One of our greatest presidents, Abraham Lincoln, gave a speech, the Lyceum Address, in 1838 talking about the importance of the rule of law.

When there are unjust laws, you have to be careful about refusing to comply with them because what you may lose in the process – the rule of law itself — is of greater consequence. He was not categorical about that, however, because the example he gave was of our nation’s founders and their commitment to the rule of law.

But think about that for a minute. What did our founders do? They committed an act of treason by signing the Declaration of Independence. They recognized at some point you have to take on the established regime when it is not only unjust, but when there is no lawful way to get it back on track. These matters frame our own nation in our own time.

Let us start with the 2020 election. What do we see and how did I get involved in this?

When President Trump, then candidate Trump, walked down that famous escalator at Trump Tower, one of the planks in his campaign platform was that we need to fix this problem of birthright citizenship. People who are just visiting here or are here illegally ought not to be able to provide automatic citizenship to their children. People laughed at him for not understanding the Constitution.

In his next press conference, he waved a law review article, and said there is a very serious argument that our Constitution does not mandate birthright citizenship for people who are only here temporarily or who are here illegally. That happened to be my law review article on birthright citizenship.

Then, during the Mueller investigation, I appeared for an hour on Mark Levin’s television show and said the whole Russia collusion story (which Trump rightly called the Russia “hoax”) was illegitimate – completely made up. President Trump thought that my analysis was pretty good, and invited me to the White House for a visit.

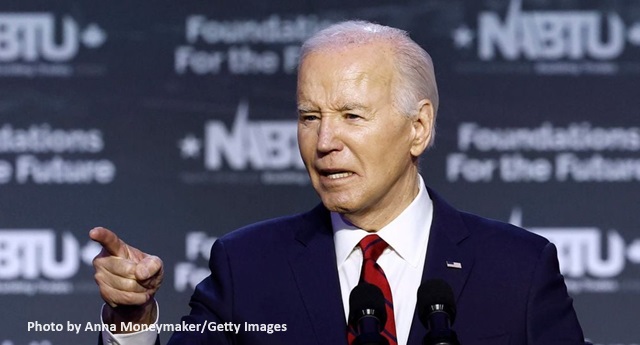

When the major law firms were backing out of taking on any of the election challenges, President Trump called me and asked if I would be interested. Texas had just filed its original action in the Supreme Court against Pennsylvania, Georgia, Wisconsin, and Michigan — four swing states whose election officers had clearly violated election law in those states and with an impact that put Biden over the top in all four.

Two days later, I filed the motion to intervene in the Supreme Court in that action. The Supreme Court rules require the lawyer on the brief to have their name, address, email address and phone number.

Nobody in the country at that point really knew who Trump’s legal team was, but all of a sudden people had a lawyer and an email address. I became the recipient of every claim, every allegation, crazy or not, that existed anywhere in the world about what had happened in the election. It was like drinking from a fire hose.

I received communications from some of the best statisticians in the world who were working with election data and who told me there was something very wrong with the reported election results, according to multiple statistical analyses.

One group decided to do a counter-statistical analysis. They said the statisticians had misapplied Stan Young’s path-breaking work. Unbeknownst to them, one of the statisticians I was relying on was Stan Young himself.

Did you ever see the movie Rodney Dangerfield’s “Back to School”? He has to write an essay for English class, the essay has to be on Kurt Vonnegut’s thinking, so he hires Kurt Vonnegut to write the essay for him.

The professor fails him. Not because it was not his own work – the professor hadn’t figured that out — but because, in the professor’s view, the work that Dangerfield turned in was not what Kurt Vonnegut would ever say. That is what I felt like with this supposed critique of the statistical work my experts were conducting.

Those were the kinds of things we were dealing with. I became something of a focal point for all this information. The allegations of illegality were particularly significant. I’ll just go through a couple of states and a couple of examples:

In Georgia, the Secretary of State, Brad Raffensperger, signed a settlement agreement in March of 2020 in a suit that was filed by the Democratic Committee that essentially obliterated the signature verification process in Georgia. It made it virtually impossible to disqualify any ballots no matter how unlike the signature on the ballot was to the signature in the registration file.

The most troubling aspect of it, to me, was that the law required that the signature match the registration signature. Secretary Raffensperger’s settlement agreement required three people to unanimously agree that the signature did not match, and it had to be a Democrat, a Republican and somebody else, so you were never going to get the unanimous agreement. That means no signature was ever going to get disqualified – and in Fulton County, election officials did not even bother conducting signature verification

Even more important than the difficulty of disqualifying obviously falsified signatures was that, under the settlement agreement, the signature would be deemed valid if it matched either the registration signature or the signature on the ballot application itself. That means that if someone fraudulently signed and submitted an application for an absentee ballot and then voted that ballot after fraudulently directing it to a different address than the real voter’s address, the signature on the ballot would match the signature on the absentee ballot application and, voila, the fraudulent ballot would be deemed legal..

How do we know that went on? Well, we had anecdotal stories. A co-ed at Georgia Tech University, if I recall correctly, testified before Senator Ligon’s Committee in the Georgia Senate. She said she went to vote in person with her 18-year-old sister. They were going to make a big deal about going to vote in person because the 18-year-old sister was voting for the first time. They did not want to vote by mail. They wanted to make an event out of it, get a sticker, “I voted,” and all that stuff. They get down to the precinct and the 22-year-old is told that she has already voted. They said she had applied for an absentee ballot.

“No, I didn’t,” she said. “Oh, Deary,” they said, “you must have forgotten.” Very patronizing. “No, I didn’t forget.,” she said. “We have been looking forward to this for months. I know I did not apply for an absentee ballot.”

They subsequently found out that somebody had applied for an absentee ballot in her name, had it mailed to a third-party address, not an address she knew. She never recognized it, didn’t understand it, and then she testified that she later learned that the fraudulent ballot was voted.

We had that kind of anecdotal evidence to prove that this change in the signature rules that Secretary Brad Raffensperger signed on to had actually resulted in fraud. The disqualification rates statewide, because of this change in the law, went down by about 46%.

Why is the change in the rules through a settlement agreement a problem? Article II of our Constitution, the Federal Constitution, quite clearly gives the sole power to direct the manner for choosing presidential electors to the legislature of the State.

When Brad Raffensperger, who is not part of the legislature, unilaterally changed the rule from what the legislature had adopted by statute, that change was unconstitutional, not just illegal.

Another alteration of the rules set out by the legislature occurred in Fulton County. Election officials there ran portable voting machines in heavily Democrat areas of Atlanta, which was contrary to state law.

Pennsylvania. One of my favorite cases comes out of Pennsylvania. The League of Women Voters, which claims to be non-partisan but is clearly anything but, filed what I believe was a collusive lawsuit against the Democrat Secretary of the Commonwealth of Pennsylvania, Kathy Boockvar, in August of 2020.

The premise of the suit was that the signature verification requirement that election officials had been applying in Pennsylvania for a century violated the Due Process Clause of the 14th Amendment because voters whose ballots were disqualified were not given notice of the disqualification and an opportunity to cure the problem.

The premise of the lawsuit was that there was a signature verification process but that it violated federal Due Process rights. The remedy the League of Women Voters sought was to have the court mandate a notice and opportunity to cure requirement.

The Secretary of the Commonwealth of Pennsylvania decided to resolve the lawsuit by providing something the League had not even requested. She decided, on her own, that Pennsylvania did not really have a signature verification requirement at all, so the requested relief – notice and opportunity to cure – would not be necessary.

Unilaterally, she got rid of a statute that election officials in Pennsylvania had been applying for 100 years to require signature verification. She then asked the Pennsylvania Supreme Court to approve what she had done.

She filed what was called a Petition for a King’s Bench Warrant to ratify what she had done. If I ever bump into her, I’m going to say, “You know, you have not had a king in Pennsylvania since 1776, maybe you ought to change the name of that.”

The partisan elected Pennsylvania Supreme Court obliged. Not only is there no signature verification requirement in Pennsylvania, the Court held, but all those statutes that describe how election officials are supposed to do signature verification are just relics; they really do not have any meaning. So the Democrat majority on the Pennsylvania Supreme Court, at the urging of the Democrat Secretary of the Commonwealth, just got rid of the whole signature verification process.

Then the court went on to say: And since there is no signature verification requirement, there is no basis on which anybody would be able to challenge ballots, so we are going to get rid of the challenge parts of the election statutes as well, and since there is no basis to challenge, the statute that requires people to be in the room while things are being counted, that really does not matter. It does not have to be meaningful observation. Being at the front door of the football field-sized Philadelphia Convention Center was sufficient even though it was impossible to actually observe the counting of ballots.

The statute actually requires that observers be “in the room,” but it was written at a time when canvassing of ballots would occur in small settings, like the common room of the local library, where being “in the room” meant meaningful observation of the ballot counting process. Obliterating the very purpose of the statute, the court held that being “in the room” at the entrance of the Philadelphia Convention Center was sufficient.

In other words, all of the statutory provisions that were designed to protect against fraud were obliterated in Pennsylvania. We ought not to be surprised if fraud walked through the door left open by the unconstitutional elimination of these statutes.

To this day, there are 120,000 more votes that were cast in Pennsylvania than their records show voters who have cast votes. Think about that: 120,000 more votes than voters who cast votes. The margin in Pennsylvania was 80,000.

Wisconsin. One of the people who has testified for me in my California bar proceedings was Justice Mike Gableman, former Justice of the Wisconsin Supreme Court. He was hired by the Wisconsin legislature to conduct an investigation.

His investigation efforts were thwarted at every turn, with the Secretary of State and others refusing to comply with subpoenas, etc. Nevertheless, he uncovered an amazing amount of illegality and fraud in the election. For example, the county clerks in Milwaukee and Madison had directed people that they could claim “indefinitely confined” status if they were merely afraid of COVID.

That is clearly not permitted under the statute, but voters who followed the county clerks’ directive and falsely claimed they were “indefinitely confined” did not have to submit an ID with their absentee ballot as the law required — again, opening the door for fraud.

Although the Wisconsin courts held that the advice was illegal and ordered it to be withdrawn, the number of people claiming they were indefinitely confined went from about 50,000 in 2016 to more than a quarter of million in 2020. The illegal advice provided by those two county clerks in heavily Democrat counties clearly had an impact.

Election officials in heavily Democrat counties also set up drop boxes. They even set up what they called “human drop boxes” in Madison, which is the home of the University of Wisconsin. For two or three consecutive Saturdays before the election, they basically ran a ballot harvesting scheme at taxpayer expense with volunteers – whom I suspect were actually supporters of the Biden campaign — working as “deputized” county clerks to go collect all these ballots, in violation of state law.

How do I know it is a violation of the state law? The Wisconsin Supreme Court after the fact agreed with us that it was a violation of state law.

One last piece. Wisconsin law is very clear. If you’re going to vote absentee, you have to have a witness sign a separate under-oath certification that the person who is voting that ballot is who they say they are.

The witness has to fill out their name and address and sign it, under penalty of perjury. A lot of these came in with the witness signatures, but the address not filled in. The county clerks were directed by the Secretary of State to fill the information in on their own. In other words, they were doctoring the evidence.

They were doing Google searches to get the name, to fill in an address to validate ballots that were clearly illegal under Wisconsin law. All told, those couple of things combined, more than 200,000 ballots were affected in a state where the margin victory was just over 20,000.

Then in Michigan, we had similar things going on. We probably all saw the video of election officials boarding up the canvassing center at TCF Center in Detroit so that people could not observe what was going on. There were hundreds of sworn affidavits about illegality in the conduct of that process in Detroit.

Then there was one affidavit on the other side submitted by an election official who was responsible for legally managing the election. He said, basically, that everything was fine, it was all perfect.

The judge, without holding a hearing on a motion to dismiss, at which the allegations of the complaint are supposed to be taken as true, rejected all the sworn affidavits from all the witnesses who actually observed the illegality, and instead credited the government affidavit – without the government witness evening being subject to questioning on cross-examination.

This is a manifestation of what I have described as the increasingly Orwellian tendency of our government. “We’re the government and when we’ve spoken, you’re just supposed to bend the knee and listen.”

That was just some of the evidence we had. In those four states, and in Arizona and Nevada as well, there is no question that the illegality that occurred affected way more ballots than the certified margin of Joe Biden’s victory in all of those states.

It only took three of those six states — any combination of three — for Trump to have won the election.

When I was coming out of the Georgia jailhouse after surrendering myself for the indictment down in Georgia, one of the reporters threw a question at me. He said, “Do you still believe the election was stolen?”

I said, “Absolutely. I have no doubt in my mind,” because of things like this and because of the Gableman report, because of Dinesh D’Souza’s book on 2000 Mules — that stuff is true.

People say, “Well, it’s not true. It’s been debunked.” No, it has not been debunked. In fact, there have been criminal convictions down in Pima County, Arizona, from the 2018 election, where people finally got caught doing the same thing that Dinesh D’Souza said they were doing.

Dinesh’s documentary was based on the investigative work conducted by Catherine Engelbrecht of True the Vote. Her team obtained, at great expense, commercially-available cell phone location data and identified hundreds of people who visited multiple ballot drop boxes, oftentimes in the wee hours of the morning, 10 or more different drop boxes. Then they got the video surveillance from those drop boxes (those that were actually working, that is), confirming that the people were dropping in 8, 10, 12 ballots at a time.

In Georgia, you are allowed to drop off ballots for immediate family members, but I think it is fairly clear that these folks – “mules” is what the documentary called them – were not family members. They were taking selfies of themselves in front of the ballot boxes because, as the whistleblower noted to Engelbrecht, they were getting paid for each ballot they delivered. In other words, this certainly looks like an illegal ballot harvesting scheme.

What has happened since then? Well, there is a group in DC, largely hard-liner partisan Democrats, Hillary and Bill Clinton crowd, but joined by a couple of hard-line never-Trump Republicans, or one, so they can claim they are bipartisan. The group is called The 65 Project, and it is named after the 65 cases brought by Trump’s team that supposedly all ruled against Trump.

Well, first of all, that mantra, how many have heard it?: “All the cases, all the courts ruled against Trump.” First of all, that is not true. Most of the cases were rejected on very technical jurisdictional grounds, like a case brought by a voter, rather than the candidate himself.

Individual voters do not have standing because they lack a particularized injury. Those were dismissed. There is no basis for claiming that there was anything wrong with the claims on the merits. It is just that the cases were not brought by the right people.

There was one case where one of these illegal guidances from the Secretary of State was challenged before the election. The judge ruled that it was just a guidance, and that until we get to election day to find out if the law was actually violated, the case was not ripe — and it got dismissed.

Then the day after the election, when election officials actually violated the law, the case gets filed again, and the court says, “You can’t wait until your guy loses and then bring the election challenge. It’s barred by a doctrine called laches. This is the kind of stuff that the Trump legal team was dealing with in those 65 cases.

Of the cases that actually reached the merits –there were fewer than a dozen of them, if I recall correctly — Trump won three-fourths of them. You have never heard that in the “New York Times.” And the Courts simply refused to hear some clearly meritorious cases, such as one filed in the Wisconsin Supreme Court. The majority in that case simply noted that it did not see any need to hear the case, over a vigorous dissent that basically said, “Are you nuts? This was illegal, and we have a duty to hear the challenge.”

Two years later, that same Court took up the issues that had been presented to it in December 2020, and it held that what happened was illegal. But by then it was too late to do anything about it.

The 65 Project was formed — I think I’ve seen reported that they received a grant from a couple of George Soros-related organizations of $100 million — to bring disbarment actions against all of the lawyers who were involved in any of those cases.

The head of the organization gave an interview to Axios, kind of a left-leaning Internet news outlet, and he said in his interview to Axios that the group’s goal with respect to the Trump election lawyers is to “not only bring the grievances in the bar complaints, but shame them and make them toxic in their communities and in their firms” “in order to deter right-wing legal talent from signing on to any future GOP efforts” to challenge elections.

Think about that. Our system works, in part, because we have an adversarial system of justice that supports it. If groups like the 65 Project succeed in scaring off one side of these intense policy disputes or legal disputes, then we will not have an adversarial system of justice.

We will not have elections that we can have any faith in, because if you do not have that kind of judicial check on illegality in the election, then bad actors will just do the illegality whenever they want, and we won’t be able to do anything about it.

They are not the group that brought the bar charges against me in California, but they did file a complaint against me in the Supreme Court of the United States. A parallel group called the States United Democracy Center is the one that filed the bar complaint against me in California. Nearly every single paragraph of the complaint had false statements in it.

The bar lawyers publicly announced back in March of 2022 that they were taking on the investigation. Under California law, investigations before charges are filed publicly are supposed to be confidential. But there is an exception if the bar deems that the lawyer being investigated is a threat to the public.

So the head of the California Bar had a press conference announcing that I was a threat to the public, and therefore they could disclose that they were conducting an investigation. Now, what is the threat to the public that I pose? What is the old line? Telling truth in an era of universal deceit is a revolutionary act? I guess that is the threat to the public they’re asserting.

That is the threat to the public. Telling the truth about what went on in the 2020 election. They gave me the most extraordinary demand. They basically said we want to know every bit of information you had at your disposal for every statement you made on the radio, for every article you published, for every line in every brief you filed. It took us four months.

I said, “We’re going to respond to this very comprehensively.” They say I have no evidence of election illegality and fraud. We gave them roughly 100,000 pages of evidence. 100,000 pages we disclosed to them. They went ahead and filed the bar charges anyway against us in January of 2023.

My wife and I, since 2021, have been on quite a roller coaster.

We came to the realization that my whole career, my education in Claremont, my PhD, my teaching constitutional law for 20 years, my being a dean, my being a law clerk for Justice Clarence Thomas, probably equipped me better than almost anybody else in the country to be able to confront, stand up against this lawfare that we’re dealing with.

This is our mission now. This is what we do. This is what I do around the clock, is deal with this.

I was teaching our summer seminar at the Claremont Institute. We do a series of summer seminars, one for recent college grads called the Publius Fellowship Program.

You may recognize some of the names of people that have gone through Publius. I was a Publius Fellow in 1984. Laura Ingraham, Mark Levin, Tom Cotton, Kate Mizelle (the judge who blocked the vaccine mandates down in Florida). We’ve had some pretty good folks.

We also conduct a program for recent law school grads called the John Marshall Fellowship. We were conducting a seminar on the Constitution’s religion clauses when the news of the Georgia indictment naming me as an indicted co-conspirator came down. We kept going on with the seminar. At the end of the program, the fellows always roast each other and make fun of each other, missteps they’d made during the week and things like that.

Well, this year, they roasted me a bit. One of the students noted that as FBI agents were rappelling down from the rooftop, Eastman kept talking about the Constitution’s religion clauses.

He recounted that, prior to the program, the students didn’t know what to expect when they accepted the fellowship offer to study with me (among others), given all that was going on. Then he said that what they witnessed on that night, when the indictment came down, was a demonstration of courage they had not seen before, and that it was contagious. He then recited a line from our national anthem – the one asking whether the flag was still flying. And he noted, with great insight, that if you listen carefully to the words, the question is not so much whether the flag still flies, but what kind of land it flies over? Is it still the land of the free and the home of the brave, or the land of the coward and the home of the slave?

I find more and more, as more Americans are waking up to what is going on, that courage is indeed contagious. People are looking for ways to help fight back. When they see somebody standing up with that kind of courage, it gives them courage to join.

There are people in every county in the country, with eyes on the local clerk’s office and verifying that, “When it says 28 people are living and voting in an efficiency apartment, we know that is not true and we’re going to get that cleaned up.”

I remain optimistic as people are awakening to the threat to our way of life. This is one of the cornerstones of our Declaration of Independence. We are all created equal. There are certain corollaries that flow from that.

This means that nobody has the right to govern others without their consent. The consent of the governed is one of the cornerstones of our system of government. Our forefathers exercised it in 1776 by choosing to declare independence, and 10 years later by choosing to ratify a constitution, and we exercise that consent of the governed principle in an ongoing way by how we conduct our elections.

Ultimately, we are the sovereign authority that tells the government which direction we want it to go, not the other way around.

Regularly, we are instead being given the following message: “We’re the government. We have spoken. How dare you stand up and offer a different view.” That has turned us from being sovereign citizens in charge of the government to subjects being owned by or run by the government.

That is not the kind of country I intend to live in. It is not the kind of country I want my kids and now my grandchildren to grow up in. This is a fight worth everything you’ve got. That’s why we’re going to do as much as we can to win this fight. Thank you for your support and prayers.

* * *

Question: What happened after the 2020 election with Justices Thomas and Alito. They wanted the Supreme Court at least to hear the evidence, but were turned down. Why?

Dr. Eastman: One of the cases that was up there was one of the other illegalities that occurred in Pennsylvania. The Secretary of State unilaterally altered the statutory deadline for the return of ballots.

Pennsylvania, like most states, says, “If you’re going to mail in your ballot, it’s got to be received by the close of the poll so we’re not having this gamesmanship of being able to get ballots in after the fact.” She said, “Oh, we’re going to give an extra week.” The court said, “No, we’ll give an extra four days.”

That case was brought to the Supreme Court to block that clearly illegal action by the Secretary of the Commonwealth, agreed to by the Pennsylvania Supreme Court. They asked for an emergency stay of that decision so the rule that had been in place would still be followed.

Ruth Ginsburg had died, there were eight people, and the court split four to four, which means the stay was denied. You had to have a majority. It was Thomas, it was Alito, it was Gorsuch, and it was Kavanaugh. John Roberts voted with the three liberals. Then when Amy Coney Barrett joined the court, I thought, “OK, we’ll get to five.”

When a motion to expedite in my case was filed in mid-December, we filed a cert petition from three of the erroneous Pennsylvania Supreme Court cases, we filed a motion to expedite, and that was denied. They didn’t even act on it.

Then February 12th of 2021, they denied the cert petition and the motion to expedite. The vote there was six to three on the ground that it had become moot. That meant Barrett and Roberts and Kavanaugh all voted to deny the cert petition. But it had not become moot.

The issue of whether non-legislative actors in the state can alter election law consistent with the Constitution remains an open issue. It should not be an open issue. The Constitution is quite clear, but there was a news account at one point reporting that John Roberts had yelled at Alito and Thomas, who had insisted they needed to take these cases. They were just like Bush versus Gore.

Roberts was reported to have said, “They’re not like Bush versus Gore. If we do anything, they will burn down our cities.” Which means the impact of what had gone on in the summer of 2020 in Portland and Kenosha and all these other places, had an impact on the Supreme Court declining to take these cases.

By the way, a little aside on that story to show you how distorted the January 6th committee, and particularly Liz Cheney was on the evidence.

At some point during the course of all this, the legislator in Pennsylvania who was conducting hearings on the election illegality in Pennsylvania wanted my advice on what the legislative authority was if they found that there was outcome determinative illegality or fraud in the election.

He sent an email to me at my email address at the University of Colorado, where my wife and I were teaching at the time.

I responded, “If there is clear evidence of illegality, that’s unconstitutional, and so you have the legal right, the legal constitutional authority to do something about it. If you think it altered the effect of the election, you should name your own electors.”

University of Colorado, contrary to their policy, disclosed that email publicly. Liz Cheney announced the email, said Eastman was pressuring the Pennsylvanian legislature to overturn the election, even though it was quite clear that my statement about legislative authority was specifically conditioned on a finding of illegality and fraud sufficient to have affected the outcome of the election.

The other gross distortion that came out of the J6 Committee involved an email exchange I had about whether to appeal the Wisconsin case to the Supreme Court. The campaign staff, money guys in the campaign said, “We’re trying to be good stewards of the funds we have. What are the chances that they’re going to take these cases? Is it worth filing these cert petitions?”

I wrote in the email, “The legal issues are rock solid. It therefore doesn’t turn on the merits of the case. It turns on whether the justices have the spine to take this on. Then I said, “And I understand that there is a heated fight underway and whether they should take these cases. We ought to give the good guys the ammunition they need to wage that fight.”

Liz Cheney or someone on the J6 Committee puts out a portion of this email. They ignore that I say the legal issues are rock solid. They say instead that Eastman, knowing his case had no merit, was pressuring the Supreme Court to take the case and obviously had inside information from Ginni Thomas, because three weeks earlier, Ginni had sent me a note saying, “I heard you on Larry O’Connor’s show giving an update on the election litigation. Can you give that same update to my Zoom call group? By the way, what’s your home address? I need it for the Christmas card.”

That was the email. All of a sudden, Liz Cheney and the J6 Committee puts those two things together as if there was something nefarious about it.

My understanding that there is an intense fight underway at the Court was based exclusively on the news accounts in The New York Times about Roberts yelling at Alito for insisting that the Court needed to take these cases. The dishonesty, the combination of the dishonesty, the whole thing, this narrative is out there and it is the government narrative.

No matter how false the narrative is, we are supposed to just accept it or bend our knees. “It’s like, the government says, ‘We’ve increased your funds this year from four to three,’” and we’re just all supposed to accept it. This is lawfare, but it is support of totalitarianism, of authoritarianism.

The government has spoken, and we are all supposed to accept it as true, no matter how obviously false it is. I’m sorry, free people should not and never have and never will if they continue to be a free people tolerate that kind of thing.

Q: I have two questions. One, when Raffensperger did that in Georgia, was it expressly to defeat Donald Trump? Do you think he knew what the ramification of that ruling was going to be? The second thing is, in this upcoming trial, is there an opportunity to lay out publicly for a jury?

Is this a jury situation, the talk you just gave us? Because there has to be a moment where people pay attention to this, and so far it has not happened.

Dr. Eastman: So far it has not come, I agree. I mean, it has come, but in ways that are immediately shut down. We are laying out the case now in my California bar trial, which next week enters its eighth week. My defense of my California bar license will have cost us a half million dollars before all is said and done.

Being a full trial team for eight weeks, it’s gone on. It is insane, but we are laying out the case to the extent the judge permits. She has already blocked about a dozen of my witnesses, but I’ll tell you some of the stories. We have a guy named Joseph Freed, retired CPA, professional auditor, auditing Fortune 500 companies his whole career.

He said something doesn’t smell right here, and so he applied his tools of the trade to look at the elections and wrote a book called “Debunked.” It’s a brilliant book. I told my wife, “This is the book I would have written if I hadn’t been on my heels playing defense the last year.”

The book was written and published in January of 2023, so the judge ruled it was not relevant because even though it discusses all the evidence I had before me, the analysis he did was after the fact and I could not have relied on it, therefore it was not relevant.

Two days later, the government offers a witness to introduce into evidence government reports that were done in September 2022. My lawyer objected, “It’s not relevant on your prior ruling.” The lawyer for the bar actually said, “Well, these are government reports. They are different.” So the judge let them in.

Part of the problem is, trying to prevent the story from getting out, even in a trial where the rules of evidence are supposed to come to play. I don’t think they’ll be able to get away with that in the Georgia criminal litigation.

This full story probably will come out more clearly there and it will have a bigger viewership there than my California bar trial has had because Trump is one of the defendants. The California bar trial is exposing a lot of this.

A reporter for the “Arizona Sun,” Rachel Alexander, is doing a terrific job covering the case in daily articles in Arizona Sun, but she also she has a Twitter account.

What I’ve seen this far from the state trial judge down in Georgia is that he is going to hold the line on what the law is and what the law requires. That is a very good thing and we’ll be able to see it. Fingers crossed.

About Raffensperger, look, I don’t know what his motives are, all I can see is the consequences of them. There are the consequences of that, which should have been obvious on its face. More importantly, there is the continued falsity claims in his public statements, and I’ll give you one example.

One of the expert reports on the election challenge that was filed — which never got a judge appointed, by the way, for nearly a month, and by then it was too late.

One of the allegations based on an expert analysis was that 66,247 people had voted who were underage when they registered to vote.

Now, he goes out and does a press conference and says, “We checked, nobody voted when they were underage,” but that was not the allegation made by the expert. The allegation was that they registered to vote when they were 16. You have to be 17 and a half before you can register.

If they had not re-registered, that meant they were not legally registered and not legally allowed to vote. He routinely mischaracterizes the actual allegation in the case, deliberately lying. Whatever his motives were with whether he’s anti-Trump or not, he is clearly lying, and we ought not to give him any credence whatsoever.

Q: You had said before that President Trump had won three quarters of the real cases. I’m wondering what that means to win, what are the implications of that and what is correct, if anything. What, then, then is the way forward?

Dr. Eastman: The way forward is a legal system. Now, the Trump cases that were won only involved small components like the statutory right in Pennsylvania to be there to observe the counting. They were blocking even minimum observation. The court ordered, “Yeah, you’ve got to let them into the room and observe.”

That was not one that was the grand enchilada on the outcome determinative issues, but he won the case. We won ultimately on the indefinitely confined ruling up in Wisconsin. They said that, “Just being fearful of COVID does not mean you’re indefinitely confined under the statute.”

It’s not as if the Wisconsin legislature didn’t have an opportunity to alter that. If they wanted, they determined, they considered alterations in the law as a result of COVID, made some, but this was not one of them.

What I have seen, and it pains me to say this, is that the level of corruption in our institutions, including our judicial institutions, is so pervasive now that it is troubling. Because many of these cases end up in the DC courts, I cannot imagine a stronger case for change of venue than those January 6th criminal defendants.

Yet their motions for change of venue were uniformly denied because they wanted this in the DC jury pool, which is like 95% hostile to Trump. This is not a jury of peers. This is not a jury that is likely to lead to a just and true result. This is a partisan political act, a loaded dice system in DC.

The same thing I think they were gambling on being true in Georgia, in Fulton County. But I don’t think the dice is as loaded there as it is in DC.

It will cost a million, a million and a half to defend against those charges. The poor guy who entered a plea agreement and pleaded guilty last week, one of the 19 defendants in Georgia, he is a bail bondsman for a living.

If he gets a felony, he is not only in jail for a while, but he cannot do his trade, so they offer him a misdemeanor conviction and no jail time. He took it in a heartbeat. Otherwise, he is looking at a million to two million dollars in legal fees tied up in this internationally televised drama for nothing, and he was not in the position to undertake that.

We have raised over a half million on my legal defense fund site. It’s probably going to end up being three million total that we need, but he did not have the ability to do a hundredth of that.

In international news: “Oh, one of Trump’s co-defendants is turning the tables on Trump. This is bad news for Trump.” No, it’s not. The guy made the most sensible decision he could.

My lawyer got a call from ABC, they said, “Have they reached out to you to offer a plea agreement?” I told him to say “No, I suspect they’re not going to, but I’ll tell you what. I’ll make a suggestion to them. I will agree to a plea agreement that says they drop all the charges, and I will agree to testify truthfully on their behalf. In exchange, I agree not to file a lawsuit for malicious prosecution against them.”

I thought that was a pretty good offer.

Q: You’re paying with your money. They’re paying with the…

Dr. Eastman: Yeah, they’re paying with my money too, taxpayer money.

Q: What about the ability to manipulate electronic voting machines? It was on every single broadcast for weeks.

Dr. Eastman: I quickly became a triage nurse. Once I filed that brief on behalf of Trump and everything started coming in. I had to try and make the best judgment I could about what kind of allegations were credible and what allegations were not credible. What things that would appear credible that we could prove versus the one that seem credible, but we cannot prove them. I’ll give you one example.

Early in January, Mike Lindell from MyPillow said he had a list of the Chinese intrusions. He has got 50 pages of spreadsheets purporting to show IP addresses in Beijing connecting with IP addresses in county election offices all over the country, and then altering Trump down 45 votes in this precinct or altering the totals as they are getting transmitted to the secretaries of state that then become part of the reported vote totals.

I had the first 10 lines of that spreadsheet on January 2nd, and I had some of the best security experts in the world that I was working with, and I said, “Can we verify this?” — because they commonly describe how many Trump votes were lost, but obviously just typed in. I said, “I need to see the data, I need to see the packet that you say is sending instructions to make these alterations.”

They wanted me to go to the president with this stuff and I said, “If in fact this is true this is an act of war by the number one other superpower in the world against the United States.” Taking that information into the president without confirming it would be an imprudent thing to do.

I wanted to confirm it and my experts, who had access to IP address registries, said none of the IP addresses were valid. This is made-up stuff. So, I was not able to confirm it. Now, maybe this occurred, but the data I was looking at was not the silver bullet of evidence that we needed to be able to take it.

Other stuff, do you know…how many saw the vote spike charts? Some entrepreneur started making T-shirts out of them. Those big vote spikes, you saw that chart over the Internet.

Well, think about that for a moment. Atlanta, which is about 90% Democrat, if they are not reporting partial returns all night long the way the rest of the state is, and then they report all of their returns all at once, you are going to see a vote spike for the Democrat.

If they are reporting partial returns all night long, the way the rest of the state is, and then you see that kind of vote spike, that is pretty good evidence of fraud. I asked, “The data we are looking at that gives us that vote spike chart, that famous Internet graph that everybody saw is based on state-wide aggregate time-series data. I need to know whether Atlanta is reporting what we would expect or whether it’s fraud.” How do I get that information? I need the county level time series. Let’s see what was going on in Fulton County alone.”

I’m told that Georgia officials locked access to the county level time-series data that would have helped me determine whether it was evidence of fraud or evidence of something that we should have expected. To this day, I do not know, but those are the things I was trying to do to get to the bottom of this information.

About electronic voting machines? There have been three audits. Antrim County, Michigan, and one of the leading critics of voting machines and their software is a guy named J. Alex Halderman, a professor of computer science and engineering at the University of Michigan.

He testified as the expert in litigation down in Georgia in 2018 saying these machines are not secure. They sealed his testimony and it was only released in June. It just says, “These things are susceptible to fraud by all sorts of bad actors.”

He was the government witness in Antrim County, and he demonstrated that, in his opinion, what really happened in Antrim County was that some of the local clerks had done an update. One of the cities in the county had omitted one of the school board races, and so they had to redo the ballot.

Unbeknownst to the county clerks, every line in the machine code was consecutively ordered throughout the whole county. If you add one line in Bailey Township, it doesn’t affect the cities in the county that began with A, but it affected everything else.

All the votes for Jorgensen were cast for Trump, all the votes for Trump were cast for Biden. All the votes for Biden were cast for the line marked “President” and didn’t count. When they unraveled that error and counted the actual ballots, it looked like this was an update in the software error and it was explainable.

Halderman goes out of his way, however, not to distance himself from his prior concerns about the vulnerability of election.

One of the things we discover in that Antrim audits is that in fact, the vote logs that are supposed to be there had been deleted for 2020, not 2016, not 2012, they’re still there, but 2020 had been deleted.

We also found that the password for access to the machine, that give you, the administrator, rights that would allow you to delete logs, was the same password that everybody had access to anywhere — from county clerk to anybody — they had the same password. 123456 or something simple like that was the password. It had been that way since 2008.

The audit uncovered huge vulnerabilities, but because the logs had been deleted, no proof. A second audit was done in Mesa County, Colorado. A woman by the name of Tina Peters was the county clerk in Mesa County, Colorado.

The Secretary of State in Colorado, a radical advocate named Jena Griswold, had ordered an update to all the machines in the county shortly after the election. The update destroys all the election evidence, and that is a violation of federal law.

All election information is supposed to be kept for 22 months, and the people that are on the hook for the violation of that federal law –and it is a felony — are the county clerks. Tina Peters said, “I’m not going to allow them to put me in way of a felony indictment of letting this information be destroyed.”

She made a mirror-image copy of all the data so that when they did the upgrade, she could say, “I haven’t violated federal law. I’ve got it.” She had the mirror image, and she hired forensic analysts to look at.

They are now charging her with nine felonies for illegally accessing the information, but what they discovered in that audit, they actually identified computer code that was changing votes. Now, Jeff O’Donnell was the guy that did it. He published three reports, the three Mesa County reports. I called Jeff O’Donnell as one of the witnesses of my California bar trial. The judge has barred him from testimony. We had not identified him up-front because this was going to be rebuttal to their claims that everything was fine. The third audit has occurred down in Georgia. There’s one case still pending from all of these things from three years ago. The case is called Favorito vs. Raffensperger.

Garland Favorito runs an organization called Voter GA, which has been doing election integrity oversight stuff in Georgia for 20 years. He is neither Democrat nor Republican. He is a Constitution Party guy, sorry.

There was a judge down there. Apparently this judge did not get the memo that we are not supposed to look at any of this stuff, and he authorized Garland and his team of forensic experts to access one of the machines in Fulton County, and he gave them forensic audit access.

They had it for about a week before somebody came down on the judge and said, “Oh, we’re not supposed to do that,” and the judge revoked the order. In that week, they discovered something very stunning. Think about how this works:

At first in our history, it used to be that you would go to both of your local precincts, and maybe the local library, and absentee ballots would get mailed in and delivered to that precinct, so that the absentee people who had voted from the same neighborhood were counted with the in-person votes.

This year in all the big cities, they had big central balloting and counting facilities: State Farm Arena in Atlanta, the Philadelphia Convention Center, or the TCS Center in Detroit.

This meant that absentee ballots are in from all 490 precincts in Atlanta, in Fulton County. They are randomly put through, they do not come all “in batches,” such as, these are all the ballots from precinct number one, or whatever. They are random.

They get put in, they get opened, and they get stacked into piles of a hundred, and then they get scanned. Now think about that. That means you have 490 different ballots being scanned. Every ballot, every precinct, has different races on it, different school board races, different things.

The ballot has a code to tell the machine which key to look to in order to know how to count those dots on the ballot box. Every 100 with that randomized listing of precincts creates a unique digital signature for that hundred. For mathematicians, that is 100 to the 490th power, because there are 490 precincts.

The odds that you have a duplicate batch of a hundred are zero. 0.0000001. Infinitely small chance that they would have anything. In their one week on one machine, they discovered 5,000 ballots with identical digital signatures in batches of a hundred.

The margin in Georgia was 11,779. They did this on just one machine, looking at it only a partial bit of time for one week. These are the three audits we had. We know the machines either have been hacked or are open to bad actors with access to the machines, either put in a thumb chip. Halderman’s the guy.

They had a convention in Las Vegas, hired a bunch of geeks, computer geeks from around the country, to come to this convention and see who could hack into the machines and alter the vote codes quickest. It took people about 15 minutes.

Halderman is also the guy. What is one of the big rivalries in the country, Michigan versus Ohio State? He had his Michigan students vote on who had the better football program, Michigan or Ohio State.

Now, anybody that knows anything about football knows there’s no way anybody in Michigan is ever going to vote for Ohio State, but he programmed it so that Ohio State won by 80 percent. It took him five minutes.

Michigan students voting on one of his Dominion machines, when this was the issue, the ballot initiative, voted for Ohio State. The notion that these things cannot be hacked is laughable. They have to be able to be opened if they need to be repaired. [I heard that from an MIT graduate at the time.]

The question is, how to prove that they were hacked in this particular instance when they are destroying the evidence, and that is where we are.

Q: Do the Republicans do this too?

Dr. Eastman: I don’t know. There was a story that was floated that the former Secretary of State in Arizona and former governor, who was running a distant fifth in the primary election for governor before he signed the $100 million contract with an electronic voting machine company, and all of a sudden he won the election, or the same thing that happened with Kemp in Georgia.

Those speculations have been floating out there that their bribery was not cash into their bank account but votes in their upcoming primary elections. I do not know whether that is true or not. Those allegations have been floated. It would not surprise me .

Stacey Abrams certainly thought Kemp stole the election. There was a whole litigation on it. That is why Halderman was doing his expert reports in that case.

More troubling, though, are the people that knew that there was something amiss and refused to do anything about it because they did not like Trump, or they do not like the Trump populist uprising movement that Trump is leading.

Remember, Trump did not create this movement. We need to date it back to the Tea Party movement in 2010 after Obamacare comes down. The Republicans in charge in Congress thought that was a bigger threat to them than the Democrats were.

They wanted to do everything they could to shut down that movement. The movement just took on a new guise when a new leader stepped up to get ahead of it, and it is the MAGA movement now.

Either they do not like those people in flyover country — that may be part of it from our release in DC — or they do not like anybody questioning the utter corruption that is making them all multimillionaires with having government jobs or some combination of both.

What was most discouraging was finding people saying, “Oh, I wish we could do something about this election illegality,” and then, on the back side, doing everything they could to stop it.

Former Attorney General William Barr is the primary example of this. Barr goes out on December 1st, and said, “We’ve been investigating, and we found no evidence of significant enough fraud to affect the outcome of the election.”

One of the charges against me in California is, “You continue to insist there was illegality even after Bill Barr made that statement. Why didn’t you bow to him?” Well, we subsequently learned that despite Barr’s public statement that US attorneys could investigate election illegality, anytime somebody did, he called him on the phone and order them not to.

In Pennsylvania, the US attorney in Pennsylvania, McSwain, was looking at the truck driver incident. Barr told him, “You hand all that over to the attorney general of the state” — a Democrat who was part of the problem.

One of the FBI investigators who was actually getting to the bottom of this got a call that said, “Stand down.”

The investigation of the ballots coming out from under the table and being counted after everybody was sent home down in Atlanta, the FBI did investigate that. Guess what the purpose of their investigation was. To determine that the statement that there were suitcases of ballots rather than bins of ballots was false. They did not do any other investigation about whether in fact people had been sent home.

You have people out there saying, “Oh, we’re investigating. Everything’s fine,” while behind the scenes ordering people not to do the investigation that would actually get to the bottom of it.

I call it the uniparty. You can call it the deep state. You can call it the administrative state. You can call it the corrupt state, but it sees the MAGA movement as the biggest threat to its syndicators. It is going to do everything it can to destroy the people who are going to try and publicize what is going on.

That is what we are dealing with, and we are $2 million in. One of the lawsuits that was filed against me by this guy down in North Carolina, I don’t know why he picked me as the lead defendant, but other defendants are all billionaire oligarchs who are using their own wealth. That is the kind of nonsense I’m dealing with.

This article is based on a briefing from John Eastman to Gatestone Institute.

*****

This article was published by The Gatestone Institute and is reproduced with permission.

Image Credit: Shutterstock