Why The Public Does Not Love Bidenonmics

By Neland Nobel

The Biden Administration is frustrated. After dumping fiscal stimulus that exceeds both the New Deal and the Great Society into the economy, he gets strikingly little political payback for such lavish handouts. The economy has been growing at a decent rate, unemployment appears rather low, and the stock market has been doing much better than many anticipated.

To be sure, much of this recovery is simply a bounce back from the severe COVID lockdown that the Federal bureaucracy imposed on all of us, but still Democrats want to take credit. However, one must admit that rumors of recession have not proved true so far and Biden should be benefiting from a better economy than expected.

But Democrats don’t seem to be getting much love from the voters. This has frustrated both politicians and especially the news media, which faithfully carries the Democrat talking points. Why is this happening? We have a theory to share with you.

Economists like to categorize inflation as “demand pull” or “cost push”. The former refers to fiscal stimulus which supposedly enhances new demand because of the inflationary money put in the system. The latter refers to supply chain disruptions, which force up the cost of goods and services due to shortages and bottlenecks like we saw with the COVID lockdown period.

We would like to offer another type of inflation, which is currently dogging the Democrats. We will call it “In Your Face Inflation.”

This is the escalation in the price of goods and services that people feel quite personally because it is right in their faces and unavoidable. No amount of seasonal adjusting and statistical tomfoolery can hide the problem. No amount of media spin can conceal the problem either because the voter is made aware of this inflation directly, and not through information intermediaries.

Think of everyday purchases. Buying gasoline and groceries, paying for medical and auto insurance, getting an auto repaired, and eating out, are good examples.

Just in the last four months, oil prices as measured by West Texas Intermediate, have risen from $70 a barrel to about $85. That is an increase of over 20% in a short period and now we are headed into the peak summer driving season. Having already drained the Strategic Petroleum Reserve for political reasons, Biden does not have that trick to use again. Moreover, his Administration, which had famously declared the Middle East to be calm, now presides over Houthi pirates disrupting shipping as well as a growing war between Iran, Iranian proxies, and Israel. The Ukrainians have hit Russian oil production as well. Despite record production from American producers whom Biden despises, there is not a lot of good news on the energy front.

Higher oil prices send the cost upward of not just fuel, but the thousands of products made from petroleum. It also pushes up the cost of transport. Don’t expect much relief from the airlines for your summer vacation either.

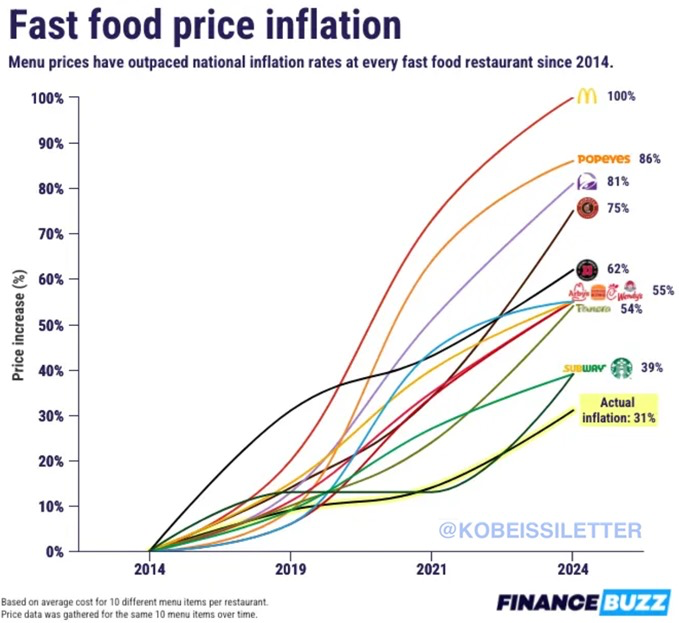

Food prices have escalated and Democrat insistence they know better than markets where to set wages, has sent the cost of eating out up very sharply. Many working-class Americans who eat at fast food establishments are feeling the love of Bidenonmics.

The Federal Reserve, after widely advertising coming rate cuts, is hesitating because inflation numbers keep coming in hotter than anticipated. The 2% inflation rate that was supposed to allow for rate cuts just is not happening. Indeed, Bank of America just forecast that inflation will be closer to 4.8% by the end of the year. That may not be the worst of it. Even arch Progressive Larry Fink of BlackRock, who has done so much to force ESG down our throats, recently said that if inflation were calculated by the government using the same formula as the 1980s, inflation would be closer to 12%.

No rate cuts mean high costs for credit card borrowers and continued difficulty for homebuyers. No rate cuts will likely disappoint an overvalued and frothy stock market.

On the other hand, if the FED does cut while inflation is running this hot, it will convey an ominous signal to the markets as well. It will suggest that politics are more important than controlling the rapid erosion of purchasing power. It has taken a while for people to forget their previous errors. Remember when they said inflation was too low under Trump and managed to get it from under 2% to 9% and then said it was transitory?

Speaking of home buyers, the combination of housing price inflation and higher mortgage costs has forced the median monthly mortgage payment to a record high in April. It now averages $2, 747 per month, putting the average monthly mortgage payment up a stunning 69% just since 2021.

Credit card debt has been exploding. In prior articles, we suggested this was likely not because people were so confident about the future, but because they were so pressed by inflation they are being forced to borrow at ridiculous rates. Not surprisingly, this is causing a historic surge in late payments, often a precursor to defaults.

Biden likes to take pride in the unemployment rates. CNBC recently said the strong US job market is in a “sweet spot.”

But others have noted almost all the jobs added are part-time jobs and many are going to illegal aliens. The number of people holding multiple jobs is soaring. The real surge in employment has been with the government. That likely does not feel like a healthy job market to most of us.

The price of used cars and new cars is substantially higher. Because of that and rising labor costs, auto insurance is up about 22% in the past year.

In short, if you are a normal person buying gas, eating at McDonald’s, and trying to insure your car, you feel the power of Bidenomics to reduce your standard of living.

If you are looking for the typical big purchase items such as buying a car or home, the costs are certainly up considerably more than the fabled 2% Biden and the Fed keep talking about.

Because this pain is so obvious, this is likely the reason most people are unhappy and no amount of huge ad buys by the Democrats are likely to obscure this reality.

All is not lost for the Democrats. Likely what will be attempted is to take the public mind away from kitchen table economics by appealing to emotion. They will try to scare the populace as to the “threat to democracy” posed by Donald Trump or divert the public into other things that poll well, such as abortion. And then again, there is always war.

TAKE ACTION

The Prickly Pear’s TAKE ACTION focus this year is to help achieve a winning 2024 national and state November 5th election with the removal of the Biden/Obama leftist executive branch disaster, win one U.S. Senate seat, maintain and win strong majorities in all Arizona state offices on the ballot and to insure that unrestricted abortion is not constitutionally embedded in our laws and culture.

Please click the TAKE ACTION link to learn to do’s and don’ts for voting in 2024. Our state and national elections are at great risk from the very aggressive and radical leftist Democrat operatives with documented rigging, mail-in voter fraud and illegals voting across the country (yes, with illegals voting across the country) in the last several election cycles.

Read Part 1 and Part 2 of The Prickly Pear essays entitled How NOT to Vote in the November 5, 2024 Election in Arizona to be well informed of the above issues and to vote in a way to ensure the most likely chance your vote will be counted and counted as you intend.

Please click the following link to learn more.

This article is courtesy of ThePricklyPear.org, an online voice for citizen journalists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit ThePricklyPear.org for more great content.