Will Seasonal Strength Become a New Bull Market?

By Neland Nobel

Our last market commentary noted that the stock market was very oversold, both in momentum and particularly in sentiment. As we moved to the end of October, we entered a period where “seasonal” strength is typical. The combination of “oversold” and seasonal strength prodded us to become more bullish on the market, at least for the next few months.

We thought downward pressure might continue into the first week or so in November, but the market had other ideas and began a strong rally almost starting from the turn in the monthly calendar. The S&P has jumped almost 12% and other indices are moving as well, including the long-neglected small caps. We have had a good year in the last month.

The market generated some very strong but arcane technical signals, particularly what are known as “breadth thrusts”. These are days where advancing issues overwhelm declining issues, with good volume. While there are particular definitions for different types of thrusts, one in particular (The Zweig breadth thrust) seemed to get the most attention.

It historically has had a good reputation. It was named for Martin Zweig, an innovative technician who was for younger readers, a frequent guest with Lewis Rukeyser on the PBS show “Wall Street Week.”

Without getting deep in the technical weeds, the importance of these signals, if you believe them, is that they signal more than a rally. They signal a change in overall direction, from the bear phase into the bull phase. In short, these signals suggest that strength will be much greater and much more enduring, than a rally for several months.

From a tactical perspective, we suggested the market was going higher. For the next month or two, we still believe that will be the case. But has the market changed phase into a bull market that will advance for a year or two?

The honest answer is we simply don’t know. The prospect of recession and a bizarre year of politics still lies ahead which complicates matters considerably. The market never really fell to areas of undervaluation and constant governmental interference is playing havoc with traditional signals. It may be that reliable signals have been going haywire because of massive governmental interference. If so, how is one to know which should be relied upon and which have been short-circuited?

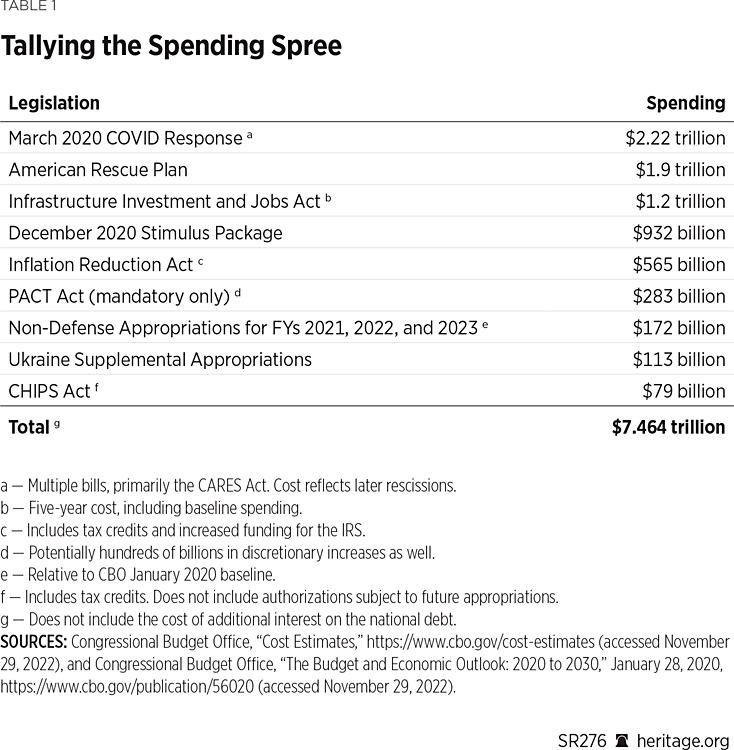

To give you a sense of just how immense government stimulus has become, see the chart below from the Heritage Foundation. Some of this money is still unspent.

The spending spree is beyond any historical comparison and likely has played a role in delaying a recession, even as quite a number of recession signals have been flashing for months. Remember government spending is counted as GDP. It may well be playing a role in making once-reliable indicators, less reliable or at least, more delayed.

Another concern is that the market has surged so strongly coming out of the gate in early November, that it is now getting back into overbought territory as it relates to momentum and sentiment. As for the latter, the CNN Fear and Greed gauge hit several lows at or below 20 during October and registered 22 as late as October 27, just before the big rally started. Now, it has soared in the space of a few weeks all the way back to 67, which is back to “greed”, but not “extreme greed” in their terminology. If we get over 75, it signals “extreme greed”, which is a reading worthy of caution.

Just from an anecdotal standpoint, the number of pundits and articles suggesting the FED has achieved a “soft landing”, and that inflation has been conquered and that interest rates will be falling is very lopsided. Not surprisingly, this chart courtesy of Wall Street Silver and Bloomberg, shows once everyone believes in a “soft landing”, the economy promptly goes into recession. This tends to confirm the “theory of contrary opinion”. Recall, that as applied to markets, it is not that the opinion is necessarily wrong, it is that when it is pervasive and widely accepted, then that opinion has already been incorporated into the price structure. The modification here is that when nobody expects a recession, the more vulnerable the economy is to recession. Why prepare for something with such a low probability of happening?

From the perspective of momentum, you can see by the price chart that many momentum indicators have also swung from oversold to overbought in a very quick fashion. That is not helpful either, even though we must give some weight to all the breadth thrusts the market has registered.

In short, it would be healthier for the market if the rally had been a bit more subdued and tentative, rather than having such a dramatic shift in both opinion and market momentum. As you can see in the red rectangles, our standard indicators of momentum are back in the frothy range. The moving average conditions remain favorable for the market.

We certainly think investors should now allocate more to stocks than was the case in September-October. That indeed turned out to be a good time frame to be a buyer. But does the preponderance of evidence justify a wholesale retooling of the portfolio for a multi-year bull market?

We would say NO, at this time, but our mind is open to seeing more evidence. We still think a recession is not only likely but there is considerable evidence it may have already started.

Yes, a recession will allow for a drop in interest rates and moderation of inflation, which is bullish for stocks. However, the decline in earnings and the defaults inherent in recession, are not. The initial decline in rates should support the market and the bond market as well, but the later effects of the recession could be damaging. This suggests more of a multi-month rally than a multiyear bull market.

In addition to the possibility of falling earnings, we still think some kind of “credit event” is likely, due to the excessive use of debt while money was virtually free. Two disturbing stories have surfaced recently. One is the US banks sit on $650 billion in unrealized losses on their bond portfolios (bonds go down when rates go up). The second is that while US banks are clearly under pressure, the FDIC has scandal-level excursions into alcohol and sexual misconduct to be investigated. It is discomforting to know that at this time of crisis, our banks are being supervised by a frat house.

Everyone’s circumstances are different, and anything we say is generalized advice anyway. Consulting with your own financial advisor (if you have one) is warranted and a good year-end review of where you are should be undertaken.

Bottom line, we think a modest shift in portfolio allocation is warranted, but the evidence remains too murky and conflicted to make drastic portfolio changes.

*****

The chart of stock action is courtesy of stockcharts.com and is drawn by the author.

TAKE ACTION

As we move through 2023 and into the next election cycle, The Prickly Pear will resume Take Action recommendations and information.

This article is courtesy of ThePricklyPear.org, an online voice for citizen journalists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit ThePricklyPear.org for more great content.