The Relevance Of Gold Price History

By Neland Nobel

Having spent 45 years in financial services, we recognize how difficult it is to estimate what markets will do. Yet, the human brain wants to have “some idea” of the potential of a given investment over time. After all, don’t we all want to own something that will be going up with significant potential and avoid something that could go a lot lower with significant risk?

Of course, we do, and that is what drives investment decisions, flawed though they may be. Compounding the problem, these decisions are typically made when money is available, which may or may not make the timing fortuitous. Because of this difficulty, many give up on the project altogether and simply “buy and hold for the long term.” Others decide with the best available information, knowing full well there still is a large element of chance in their decisions.

But what if you have money to place and you don’t have a long-term? One of the ironies of life is when you should be investing (in your twenties) you don’t have any money to speak of and when you do when you are 80, you don’t have the “long-term” left to experience the move.

After our last piece on gold (What If A Market Roared And Nobody Heard It), we caught the break out in gold and at present it seems to be rolling along rather nicely. The price move aside, we still wonder what it may mean for all markets.

The move so far has been fairly large and has surprised Wall Street. Gold is not supposed to be going up when stocks do, and when the US dollar is strong. Further, gold is not supposed to be going up with interest rates relatively high to inflation. Yet, that is what is happening.

This strongly suggests our thesis that buying is mostly coming out of Asia and that the reasons people are buying is the doom loop in US Federal government finances and the financial crisis in China. US investors still remain mostly on the sidelines.

Not surprisingly, old industry associates and some clients have asked what to make of these developments in gold.

So, at the risk of looking very foolish, here are some thoughts.

First, we must all agree that the tools we have to use are very crude. All we have is history, and then we must relate present conditions to those of the past. This is tricky because no two events are the same but as Mark Twain put it, history often rhymes if it does not repeat.

We do have charts, which are graphic presentations of history, and there are some “rules” in charting that may have some significance. But sadly, there are always exceptions to these rules and thus they should only be regarded with suspicion. Charting requires interpretation and thus is not objective science like physics. It is more art than science.

So, with these caveats and limitations, let’s take a look at some gold price history and behavior.

The price of gold for most of history was amazingly stable. Sir Isaac Newton was the master of the British Mint and set the price in 1717. Gold was the measuring stick for everything else. It was not supposed to change in price but rather other prices were to orbit around it.

Remarkably, gold remained close to an average US dollar price of around $18.93 for 200 years, with some temporary variations during the Napoleonic Wars and the US Civil War.

The world changed a lot in those 200 years, in fact, compared to previous eras, arguably it changed the most in human history.

This was the era of the classic gold standard featuring price stability and limited government. However, it was upended by World War I, and sadly, so was Great Britain.

Many markets were closed or distorted for the duration of the war but by 1920, attempts were made to regain stability. Britain attempted to return to the pre-war gold standard with US dollar prices around $20-21. It was a disaster.

Then came the Great World Depression in the 1930s and Roosevelt revalued gold to $35 per ounce. There the gold price sat until the inflation caused by the Great Society and the Viet Nam War overspending broke apart the Bretton-Woods Treaty in 1971.

Gold entered a two-tiered market with official transactions still at $35 but free market transactions at $42.

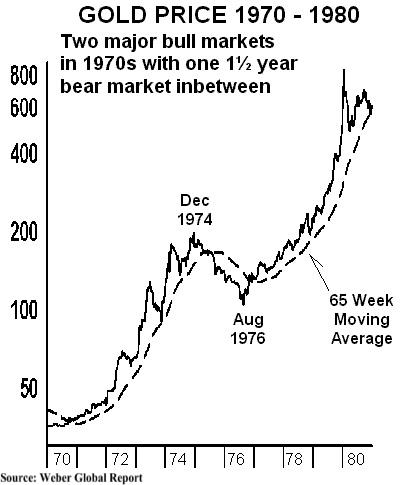

Then, political momentum was built to legalize gold in the US, which set gold loose from price controls and prices soared from $42 to $200 per ounce in 1974, just before legalization.

So, the first real move in gold in a free market was about a fivefold advance off the cycle low.

It then declined to $100 in the summer of 1976, but then ended the decade around $850 per ounce. So the second bull market in gold showed an 8 to 1 move off the cycle low.

Gold then wandered in the wilderness for almost 20 years and made multiple bottoms around $250 per ounce on the eve of both the Tech Bubble and The War on Terror in 1999-2000. Thereupon it launched another approximate 8 to 1 move with the gold price peaking at approximately $1900 late in 2011. The chart shown is a weekly chart and may not correspond to other charts. We spent more than a decade attempting to break soundly above $2000 and now we have done it.

So, if the last cyclical low was just above $1000 per ounce, what is the upside for this move? Well, the last three moves ranged from around 5:1 to 8:1, with the latter two moves the largest. In simple terms, that could mean $5000 to $8000 per ounce as possible upside potential.

Good heavens. It feels strange even contemplating such an outcome.

The first cycle with gold, from $42 to $200, was likely when gold adjusted to years of being fixed in price while everything else in society was inflated. It was like a compressed spring that needed to be released. But after that, the larger moves came as gold prices adjusted to the circumstances of the period. In short, they were more like conditions today.

One of the largest moves is the most recent, from a low of around $250 made between 1999 and 2001, to almost $1900 by 2011.

You will note that both moves in the 1970s were related to war and so was the move after 1999-2001 and the long War on Terror, which included two Iraq Wars and Afghanistan.

Certainly, war today is not out of the question. Recently, the President of Poland said Europe should prepare for war and there is news Ukraine may join NATO. Russia has made it clear for years that it would not tolerate that on its borders.

You could argue we are already at war, just through proxies.

And, we need not ignore the Middle Eastern War as Israel recently killed seven key Iranian military leaders in a surgical strike in Syria. Will Iran not retaliate? Why is the current Administration so hostile to Israel and cooperative with Iran? Why the flirtation with Iran given their role in killing our boys in Iraq and aiding the Houthis as well?

So we have at least two wars brewing and both have a significant chance of expanding.

Biden has also drained the Strategic Oil Reserve down to just 17 days and recently broke his promise to refill it because of rising oil prices.

We are already in a conflict with both Russia and Iran and a cold war with China. Oil prices are rising once again and for the first time in several years, commodity prices in general are stirring. Do you think rising commodity prices might put more pressure on inflation, perhaps delaying the FED’s expected rate cuts?

Above we show the Commodity Research Bureau’s index of all tracked commodity prices. The same pattern can be seen in the Bloomberg Index. It appears the linear bear trendline is being broken and prices have also broken through the 200-day moving average, and the average itself is turning upward. It would appear that commodity prices in general are firming. Further, they are about as cheap as we have ever seen against the major stock indices.

In terms of spending, present spending dwarfs the previous era of deficits, both in nominal and real terms. Biden spending, adjusted for constant dollars, is larger than the spending for World War I, and World War II, and 30 years of deficit spending COMBINED.

Our entitlement programs like Social Security and Medicare are also closer to insolvency than in previous periods.

Thus, from a government finance point of view, you could make a rational case that conditions are worse than in previous cycles.

What about the quality of our political leadership, the unity of our politics, the strength of our social structure, family stability, crime, and confidence levels in our government?

In terms of military prowess, do you think we are stronger than in 2000 on the eve of the War on Terror? Or, are we weaker? Then the US was considered the sole superpower. Now the Chinese are much stronger than the Soviets. True, the Soviets had a strong nuclear arsenal, but their economy was terrible. This is not true of the Chinese today. They are strong on both counts and they also have penetrated our society much more successfully than the Soviets.

Major figures in both parties are beholding to the Chinese. See the recent review we did of the book, Blood Money.

Our opinions mean little. But we ask our readers: in your view, do you think things are better or worse than conditions at the turn of the last century or back in the 1970s? Do you think America is stronger or weaker? Do you think current lawfare against Trump, the Russia collusion hoax, and two impeachments are worse than Watergate?

For those old enough to remember, and this author is among them, conditions do appear worse on many fronts. In particular, the moral and political fiber of the nation is much weaker.

If conditions are about the same or are worse than previous cycles, then why would gold not do as well off its recent cycle as in the past?

Truth be told, we have no idea what gold will do in the short term. It seems a little overbought just right now. But over the longer term, the things that drive it higher are: war, insolvency, deficits, money printing, commodity prices, and military and political weakness. Regrettably, it appears that conditions are indeed as bad, and perhaps worse, than the history around previous price cycles.

That certainly suggests gold prices will be going higher and history is our only guide.

If you are looking to add gold bullion to your portfolio, or if you disagree and think prices are peaking, please remember to patronize our sponsor, American Precious Metals. See their ad in each issue for phone numbers and addresses.

TAKE ACTION

The Prickly Pear’s TAKE ACTION focus this year is to help achieve a winning 2024 national and state November 5th election with the removal of the Biden/Obama leftist executive branch disaster, win one U.S. Senate seat, maintain and win strong majorities in all Arizona state offices on the ballot and to insure that unrestricted abortion is not constitutionally embedded in our laws and culture.

Please click the TAKE ACTION link to learn to do’s and don’ts for voting in 2024. Our state and national elections are at great risk from the very aggressive and radical leftist Democrat operatives with documented rigging, mail-in voter fraud and illegals voting across the country (yes, with illegals voting across the country) in the last several election cycles.

Read Part 1 and Part 2 of The Prickly Pear essays entitled How NOT to Vote in the November 5, 2024 Election in Arizona to be well informed of the above issues and to vote in a way to ensure the most likely chance your vote will be counted and counted as you intend.

Please click the following link to learn more.

This article is courtesy of ThePricklyPear.org, an online voice for citizen journalists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit ThePricklyPear.org for more great content.