Weekend Read: A Witches’ Brew of Negative Trends

By Neland Nobel

So, the witches’ brew in summary is sky-high stock valuations, extraordinarily high debt burdens, rising interest rates, rising inflation rates, inverting yield curves, a bond bear market, supply chain crisis caused by lockdown, energy price shock, food price shock, war, radical social change, monetary regime upheaval, and poor political leadership.

Having spent almost all of a professional career in financial services dealing with clients, it is easy to attest that almost all periods of time have hazards for the investor. It was always worthwhile to remind investors, who longed for what they thought were the “good old days” that it always has been difficult.

There are always adverse trends and perverse political developments. But within that, there continues to be human progress. Much of it has been technological, but unfortunately little of it has been social or moral progress.

Living through this period was instructive, but if you are younger, you will need to read some history to fully understand.

Just a brief history should remind us all that the “good old days” were full of difficulties such as raging inflation and war in the 1960s and 1970s. Remember how unsettling The John Kennedy, Martin Luther King, and Bobby Kennedy assassinations were? You can add to that race riots, Watergate, defeat in Viet Nam, the Iran hostage crisis, and the Crash of ’87?

Or how about the Russian default, the Thai-Baht crisis, the collapse of Long-Term Capital Management, the tech bubble of 1999, or the crash of 2007?

Along the way, we had several large wars in the Persian Gulf.

You might remember we got a twofer in 2007-2008, the dual pleasure of a housing bust and banking crisis, followed by a stock market bear crash.

Go back even further and you have Sputnik, the U-2 incident, the Suez Crisis, Hungarian Revolt, the Korean War, and two World Wars.

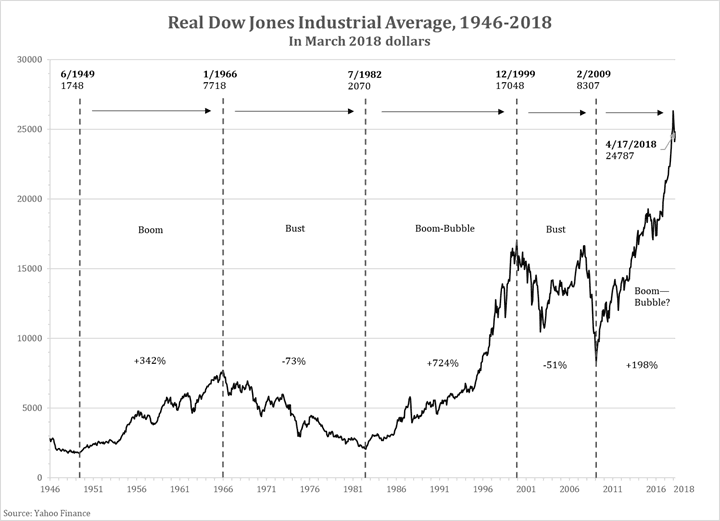

The stock market peaked in 1966 and did not return to those highs in inflation-adjusted constant 1966 dollars until 1995. Much of this occurred in what many regard as a better time in the country’s life.

In an earlier period, if one had purchased stocks in 1928, it took until 1956 to break even in inflation-adjusted terms.

Since the crash of 2008, we have had an uncommonly good run in stock values, including inflation-adjusted levels. The last few incredible years are not even shown on the chart.

The point is the “triumph of the optimists” has always carried both the stock market and economy eventually higher, although the progress was uneven. Sometimes there is a pause for years, even decades. Only in hindsight does it seem easy.

Thus, in the long term stocks, and the nation, have persevered. But there can be setbacks that take years to mend. This is particularly dangerous for older people who don’t “have the long term.”

Markets cycle. That is what they do. They go up and down, but generally more up than the down. The same is true of the economy in general.

Having set the context, we admit it would be hard to think of a similar period that had more toxic trends to deal with than the one we face today. And remarkably, almost all of them are the product of deliberate policy choices.

The question before us then is this: will this toxic brew of problems seriously set back the stock market?

What is truly scary is that any one of the trends we are about to mention, by themselves, has often caused a recession. But rarely do we see such a cluster of such potentially powerful adverse trends together, reinforcing one another when just one of these is dangerous enough on its own.

Right now, investors face a historically overvalued stock market and real estate market. Yes, expensive markets can surprise and just get more expensive. But expensive markets are also vulnerable and once they turn, the downside risk is magnified because of the gross departure from reasonable historic value.

If there is one “iron law” in market history, it is a reversion to the mean. Remarkably, so far the stock market still hovers not far from its highs and has taken only a mild correction.

Rapidly rising interest rates, especially when accompanied by inversion of the yield curve (short-term rates move above long-term rates), have reliably signaled recession. We are now seeing that as the FED must regain some credibility after uncorking the worst inflation in 40 years. Either they raise rates sufficiently high to kill off inflation by reducing demand (a recession), or we let the inflation fires burn uncontrollably for years. This is not a very good set of choices.

The rise in rates has been so far been largely disregarded by the stock market but the bond market is being hit hard. The bond market is much larger than the equity market so this loss is certainly just as important as what goes on in the stock market. But, it does not get the attention of the public.

Debt levels are far worse than they were 40 years ago. In 1980-1982 when Reagan and Volker were driving rates to nose bleed levels, Federal debt as a percentage of total output was about 30%.

Today, debt to GDP is 130%, or more than four times greater relative to output, and in many countries, it is substantially higher than that.

The cost of debt service is a function of two things: the amount of debt and the interest rate paid to borrow. Today the amount of debt is so much higher than before that interest rates well below the 1980 peak could clobber the economy and the Federal budget. How high do they go before they hurt? Who knows?

Whether the borrower is a government or a business, or a homeowner, rising rates on a huge pile of debt normally create default at the margin. Credit spreads (the interest rate between secure paper and speculative paper), are widening, indicating rising rates are beginning to bite and induce distress.

So far one country, Sri Lanka, has gone bankrupt. We fear they won’t be the last or the biggest.

During the prior periods previously mentioned, the world went through several flu epidemics and the polio crisis. The government never quarantined the healthy, such as the lockdown policies we have seen over the past two years. We also never saw the government print $7 trillion dollars and hand out money to anyone who could fog a mirror.

Lockdown has royally screwed up the world’s supply chain because except for perhaps Sweden, most of the world followed the U.S. model, which in turn, followed the model of China. As the West now emerges from lockdown, China, the manufacturing hub of the world, is once again going back into lockdown in their most populous city. That is not going to help the supply chain crisis.

Then along came Russian aggression in Ukraine, which is upending the world’s energy and food markets, and increasing defense spending. Usually, a rapid rise in energy costs alone can cause a recession. Now we get to add to that a food crisis.

For reasons cited in previous articles, the West’s response to Russia, the sanctions but particularly the seizing of central bank assets, is likely to induce a change in the international monetary structure. Once again, simply this painful adjustment, has often by itself, been sufficient to cause a recession. The monetary crisis of 1971, preceded the 1973-1974 stock market crash, which was the worst at the time since the Great Depression of the 1930s.

Again, it is not surprising that these difficulties came during a time of political upheaval (Watergate). Weak political leadership often occurs during economic crises. Inflation raged under Carter, a weak and indecisive President.

Clearly, political leadership is weak today, or perhaps even worse, it is senile.

We won’t even go into social and moral upheaval although many students of history point to 1966-1968 as a similar period. As mentioned before, the stock market peaked and did not recover to its previous highs for almost 30 years. We seem to be moving from men and women wanting to have sex without restraint (the sexual revolution born in the late 60s) to the abolition of what male and female even mean. Where will this trend end and how much damage will it do to society?

The changes in social conditions in “The Roaring Twenties”, also gave birth to the sober 1930s with the onset of the Depression.

Do social and moral upheaval cause these economic problems? It is unlikely they are the cause, but moral confusion does seem to accompany economic upheaval. We will leave that one to the social historians but that the two trends tend to come together is of concern.

So, the witches’ brew in summary is sky-high stock valuations, extraordinarily high debt burdens, rising interest rates, rising inflation rates, inverting yield curves, a bond bear market, supply chain crisis caused by lockdown, energy price shock, food price shock, war, radical social change, monetary regime upheaval, and poor political leadership.

If that list is not sufficient, we have one more to add that seems unique to economic history. In the past, when faced with difficulties, political parties tended to compromise for the benefit of the country and its citizens. After all, people elect politicians and politicians often are pragmatic.

Today’s Democrats are such harsh ideologues, especially the fanatical environmentalists, that things we could normally do as a society to ease the pain (such as drill for more energy while Russia is using energy as a weapon), cut more timber to lower construction costs, plant more acreage to grow food, and mine more metals to reduce our dependence on hostile sources like Russia and China, are taken off the table. They simply can’t be considered for ideological reasons.

Today’s Democrats would rather starve the world than bend at all on their quasi-religious belief that all climate change is caused by man’s activities. There is a strong anti-human element that has converted reasonable conservation into a religion that puts the earth first and mankind second.

Their central planning instincts have gone manic. Hubris has run amok. Unable to even clean up homeless encampments or keep the streets safe, or stop the spread of Covid, they earnestly believe they can actually change the climate of the earth in 100 years. That the earth’s climate is always changing for a variety of reasons is lost on them. They believe that they, and they alone, are responsible for altering something as complex as the earth’s temperature cycles.

Their false belief that our economic activity is an existential risk to the earth is now a real existential risk to our safety, freedom, national security, and standard of living.

Can you imagine during World War II, a political party arguing that we should not produce more energy because losing to Hitler is better than increasing carbon emissions? But indeed, Democrats are maneuvering us into energy and mineral dependence on both Russia and China, which will sacrifice our freedom and standard of living, to their earth god.

Whether they intend this policy straight jacket or even realize this, is immaterial. But their heated and fervent resistance narrows greatly possible responses to problems.

This development imposes a paralysis on possible policy options that transcends political disagreement and gets into the realm of religious war. It is hard to compromise on religious beliefs especially when they become government policy and are thus forced on others by law. Indeed, that is what has caused religious wars.

What is also baffling is that their religious practice is imposed on us, while giving rivals like China, Russia, and India a free pass. Why is Chinese carbon better than ours?

This is hardly helpful in dealing with the toxic brew of negative trends that we must respond to. Dealing with inflation has always been difficult enough without the complication of religious war over the earth god. The price of energy is being deliberately driven higher, and thus inflation higher, to force the world to adopt the policy proscriptions of the rabid environmentalist.

If the stock market can get through recent highs, and the nation avoids recession, it will be remarkable. The question remains: is that a bet we are willing to make?

This article is courtesy of ThePricklyPear.org, an online voice for citizen journalists to express the principles of limited government and personal liberty to the public, to policy makers, and to political activists. Please visit ThePricklyPear.org for more great content.