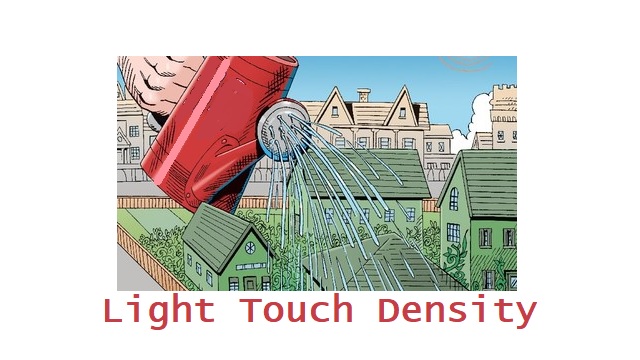

We’re living through one of the greatest housing crunches the U.S. has ever known. It’s resulted in record numbers of homelessness and entire generations certain they will never become homeowners, that critical milestone of the middle class. But there is a simple solution to the problem. The answer to our housing crisis is to legalize duplexes, triplexes, and other forms of light-touch density (LTD) housing, allowing the market to build more affordable housing options for more Americans.

The reason this is the solution to our housing crisis is simple: It increases the supply of housing for middle-income households, when what we have now is the opposite—long-standing exclusionary zoning laws that limit most areas of the nation to single-family detached homes, banning LTD homes.

LTD housing can take many forms: duplexes, triplexes, quads through eight-plexes, townhouses, cottage courts, accessory dwelling units, and other similar structure types. By allowing more units on a single parcel of land, LTD is both naturally affordable and naturally inclusionary, creating upward mobility naturally through a more accessible housing market. All it takes is repealing the laws that ban it.

This is already happening across the nation. California, Austin, and Vermont have each passed legislation entitled HOME. In California, it stands for Housing Opportunity and More Efficiency; in Austin, Home Options for Middle-Income Empowerment, and in Vermont, Housing Opportunities Made for Everyone. What these and other enactments have in common is a recognition that the solution to our nation’s worsening housing crunch is to repeal zoning laws that only allow the building of single family detached housing.

How did we end up with such laws? If you look back over the first 70 years of the 20th century, housing was generally abundant and affordable to people of all classes, though racial and ethnic segregation was of course rampant. As renowned planner John Nolan observed in 1917, building a range of housing types on varying lot sizes helps to ensure that new housing could be built that wage earners could afford. For example, in New England in 1940, duplexes, triple deckers, and four-plexes comprised one-third of the region’s housing stock and offered naturally affordable housing to the masses. Boarding homes were common as homeowners could help pay their mortgage by letting out rooms for a small fee (much like Airbnb today). For newcomers or those who had fallen on hard times, single-room occupancy buildings around bus and train stations provided a safety net in the form of cheap short-term housing. In 1970, even San Francisco was affordable.

But the economic inclusiveness and the threat of racial integration that came with these housing variations also posed a potential threat to the status quo—one that proved to be unbearable to certain segments of our government that were invested in segregation. They realized that zoning laws could be used to raise prices and rents, making homes unaffordable to Blacks, Jews, and Eastern and Southern Europeans. At the encouragement of the U.S. Commerce Department, states and municipalities started to adopt zoning laws in the 1920s, which restricted most of the nation’s residential land to more expensive single-family detached homes, while outlawing or excluding other, more affordable housing options.

These zoning policies ultimately replaced private property rights with vague and nebulous communal rights—think of the Not-In-My-Backyard or NIMBY movement—and the opinions of city planners. In so doing, they made homes and land scarce and expensive. In short, land use regulations prevented the market from building more housing, especially in high-demand places where people with well-paying jobs lived.

With the market constrained, demand eventually started to outstrip supply in high-demand cities. Home prices started to rise faster than incomes, leading to increased unaffordability. Across the country, once-affordable neighborhoods gradually priced out existing residents and potential newcomers; high prices make even older, smaller homes unaffordable to moderate-income buyers and renters.

Nowhere is this trend more visible than in California, which had home prices relative to incomes that was about on par with the national average in the 1970s. Since then, a booming economy coupled with restrictive land use regulations gave bureaucrats and NIMBYs the ability to delay for years or even stop the market from responding to any additional demand. Today, California’s home prices relative to incomes are about double the rest of the country.

To tackle today’s housing crunch, we need to build more housing to undo the damage done by misguided zoning policies. The key is to return to the light-touch density housing types of the early 20th Century.

By implementing by-right LTD across the country, an estimated 930,000 additional housing units could be created annually (depending on the maximum allowed density) over the next 30 to 40 years. This moderate density increase would expand the construction of more naturally affordable and inclusionary housing, thereby keeping home prices more aligned with incomes and keeping housing displacement pressures low.

Houston is an example of how a city can experience rapid population and wage growth and not sacrifice affordability. In 1998, as reported by Zillow, mid-tier home prices nationally and for the Houston metro were the same, while Los Angeles’ metro’s homes were 76 percent above the national level. Houston implemented a LTD law authorizing much smaller lots in 1998. By 2023, homes in the Houston metro area were 13 percent below the national level, while Los Angeles’ had risen to 160 percent above the national level. This goes a long way toward explaining why LA’s homeless rate in 2021 was 11 times that of Houston’s.

Rather than disciplined, knowledge-based policy solutions, others choose the path of scapegoating investment firms that buy up single-family homes for their unaffordability. But this reasoning fundamentally misdiagnoses the problem. While it’s true that such investor purchases have recently increased, this narrative ignores the fact that the rise in home prices long pre-dates this trend. Moreover, 50 percent of the purchases of single-family homes were made by people who own less than 10 homes, in other words, mom and pop investors. Just 10 percent are owned by mega-investors with 1,000 properties or more, as CoreLogic pointed out.

This is all cause for optimism. Knowledge based solutions are prevailing. States such as California, Washington, Oregon, Vermont, and Montana and cities such as Austin, Minneapolis, and Charlotte have also already passed reforms scaling back single-family detached zoning laws and legalizing LTD zoning. Many more jurisdictions are considering similar reforms.

Legalizing light-touch density is the most effective and politically palatable way to solve our housing crisis. LTD zoning unleashes the private sector to close the housing supply gap and provide more housing opportunities and affordable homes for more Americans.

Originally appeared in Newsweek

AUTHOR

Senior Fellow and Codirector, AEI Housing Center.

RELATED ARTICLE: Prevalence of GSE Appraisal Waivers

EDITORS NOTE: This AEI column is republished with permission. ©All rights reserved.