This weekend was the most tumultuous for the banking sector since 2008, as an apparently prosperous, mid-sized bank completely collapsed. When the dust settled, federal regulators had taken over management of two banks while several others teetered on the brink.

Needless to say, the incident has deeply shaken Americans’ confidence in the banking industry. To complicate matters, most Americans are busy shuttling their kids to school and earning an honest day’s living (as they should be) — too busy to keep up with the cacophony of opinions firing around industry jargon amid rapidly developing facts. So, for those too gainfully employed to dig through the noise themselves, here are 10 things to know about the mini-crisis in the banking sector that occurred over the weekend.

1. Silicon Valley Bank exploded since 2020 to become the nation’s 16th largest bank.

As the name suggests, Silicon Valley Bank (SVB) was based in Santa Clara, California — otherwise known as Silicon Valley. It operated 17 branches in California and Massachusetts. This location, plus the bank’s startup friendly policies, meant that SVB was the bank of choice for many tech companies, particularly tech startups funded by venture capital, operating in Silicon Valley.

Over the past three years, SVB had more than tripled in size. It began January 2020 with $55 billion in deposits and ended December 2022 with $186 billion. Last week, it had $175 billion. Two factors contributed to its explosive growth. First, COVID lockdowns created a spike in demand for digital technologies, which is exactly what tech startups intend to provide. Second, trillions of dollars in irresponsible federal COVID spending left investors flush with cash to pour into tech startups. Most of the tech startups deposited their extra cash in SVB.

2. SVB over-invested in long-term public debt.

However, the dirt-cheap interest rates at the time made it hard for SVB to make all that dough rise. You’re likely aware that banks don’t bury your deposits in the ground like the worthless servant (Matthew 25:25-27); they lend most of it out again at interest, which is how banks stay in business. But SVB couldn’t lend all those billions of dollars out with everyone already flush with cash, so they opted instead to purchase long-term, U.S. government bonds and notes. SVB purchased $80 billion in 10-year U.S. Treasury notes, along with other public debt.

U.S. treasury notes, bills, and bonds are the primary way that the U.S. Treasury finances government deficit spending. These different securities (which differ from each other primarily in duration) are essentially IOUs that yield interest over time and can be redeemed at face value at a fixed future date. For instance, a 10-year Treasury note yields interest every six months and may be redeemed 10 years after it was issued. Once issued, these notes often change hands and are considered safe, reliable assets in an investment portfolio — which means they yield a low but certain return on investment.

Longer-term Treasury notes yield a higher return than shorter-term notes, due to uncertainty about future interest rates. For instance, when SVB was purchasing Treasury notes in 2020, 10-year notes were paying 1.5% interest, while short term notes were paying 0.25% interest. SVB opted to invest heavily in 10-year notes, which paid a higher yield.

Then, in 2022, the Federal Reserve jacked up interest rates to try and combat inflation. The Fed raised the target range for federal funds interest eight times in 12 months, from 0.00%-0.25% to 4.25%-4.50%. Suddenly, SVB’s 10-year loans paying 1.5% interest weren’t so lucrative anymore.

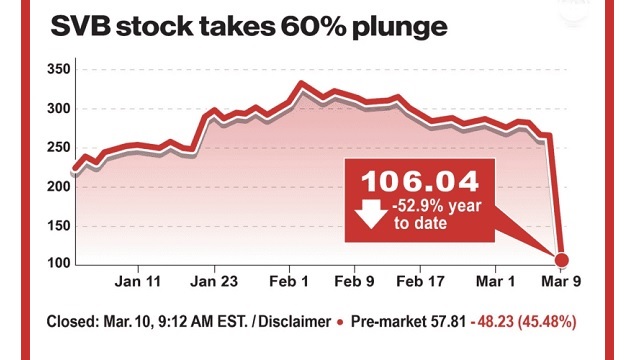

Around the same time, venture capital funding for tech startups dried up, and those companies (many of which take years to become profitable, if they ever do) began to draw on the funds they had stored up in SVB. To cover these withdrawals, SVB had to sell its long-term Treasury notes. But because market interest rates have risen, and the Treasury notes’ interest rate remains fixed, SVB couldn’t find a buyer willing to pay full price for the notes, and it had to sell $21 billion in assets at a loss of $1.8 billion.

3. SVB experienced an old-fashioned bank run.

Once it announced the losses, some investors smelled trouble and began to pull out even more money. Customers eventually withdrew an eye-popping $42 billion, a quarter of all deposits. In a new twist on an old-fashioned bank run, Silicon Valley Bank simply ran out of money to give customers on Friday, and had to shut its doors. SVB was the largest bank failure since Washington Mutual in 2008.

Andy Kessler, analyst with The Wall Street Journal, blamed SVB managers for making three critical mistakes: reaching for yield just before interest rates were set to rise, misreading its customers’ cash needs, and not selling equity to cover losses. “You’re really only allowed one mistake; more proved fatal,” he said.

In response to the bank failures of the Great Recession, Congress in 2010 passed legislation authorizing the Federal Deposit Insurance Corporation (FDIC) to insure “$250,000 per depositor, per insured bank” in case of collapse. (Congress created the FDIC in 1933, in response to the Great Depression, as part of FDR’s New Deal.) The goal was to eliminate or mitigate bank runs by creating a safety net to protect consumers.

However, most of SVB’s depositors (“something like 85% to 90%,” wrote The WSJ’s Editorial Board) had deposits that exceeded that threshold. That’s because most of SVB’s clients were companies or wealthy Silicon Valley types, and not ordinary Americans. The streaming company Roku, for example, had $487 million (26% of its cash) deposited in SVB. Unusually for a post-Great Recession bank, the vast majority of money deposited in SVB was not insured by the FDIC.

4. SVB run takes out Signature Bank, hits other banks hard.

SVB’s abrupt fall hit other medium-sized banks like a shock wave. The hardest hit was New York City-based Signature Bank, another medium-sized bank with many corporate clients above the FDIC insurance threshold. At the end of 2022, Signature had 40 locations and $88 billion deposits. But customers withdrew $10 billion from Signature on Friday, forcing the bank into the third largest bank closure in U.S. history.

Another bank to take a hit was First Republic, a San Francisco-based bank around the same size as SVB, which also had a high proportion of uninsured stocks. Its stock fell hard (as of this writing, it is down more than 60% in value) after it announced that it had gained access to $70 million in loans from the Federal Reserve and JPMorgan Chase. While the announcement likely means the bank will not fail, it also leaves investors wondering whether it was about to fail.

Bank stocks suffered across the board. The KBW NASDAQ index of commercial banks was down 11%, as even the largest, most secure banks took a hit. Some regional bank stocks like PacWest Bancorp, Zions Bancorp, and Comerica were down more than 20%. Many of the stocks grew so volatile that exchanges temporarily froze trading on them. The stock plunge could affect banks’ ability to raise money by selling shares, if they need to do so as a last resort.

5. Feds bail out all depositors, even those above insurance limit.

Federal regulators scrambled over the weekend to respond to the Friday collapse of SVB and Signature Bank. California and New York bank regulators placed SVB and Signature Bank, respectively, into receivership with the FDIC. The FDIC fired the previous executive teams and will essentially run the insolvent banks until it can find private buyers.

On Sunday, the Treasury Department, the Federal Reserve, and the FDIC issued a joint statement on the bank failures, announcing that they were “taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system.”

“Depositors will have access to all of their money starting Monday, March 13,” they promised, but “Shareholders and certain unsecured debtholders will not be protected.”

“No losses will be borne by the taxpayer,” the joint statement continued. “Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

6. Federal response creates incentives for bad behavior.

This last declaration from the federal agencies amounts to the government taking money from banks that did not collapse, in order to pay off the uninsured deposits from the banks that did collapse. National Review’s Philip Klein wrote,

“Defenders of this decision will try to make it seem as if it’s an extraordinary, one-off decision by regulators, but in practice, it has created a huge moral hazard by signaling that the $250,000 FDIC limit on deposit insurance does not exist in practice. The clear signal it sends is that when financial institutions make poor decisions, the government will swoop in to clean up the mess.”

“Moral hazard” is an economic concept that describes how people will engage in riskier behavior if they are protected from the consequences.

7. Federal government compounds bad policymaking with more bad policymaking.

While SVB executives bear some of the blame for the bank’s sudden collapse, poor federal policymaking played a role, too.

COVID-era lockdowns and excessive deficit spending — including direct payments to individuals kept from working by government policy — helped to create the cash glut that led SVB to grow too big, too fast, with nowhere to reinvest its deposits. These panic-driven polices, which didn’t even make sense at the time, occurred in both 2020 and 2021, under both a Republican and a Democratic president, and many of the spending packages received bipartisan support.

This cash glut also caused inflation, which the Federal Reserve has tried to fight by raising interest rates. Despite the bank collapses, on Monday stock traders said there was an 85% probability that the Fed will raise rates another 0.25% when it meets next week. Like a water skier lifted airborne by one wave and body-slammed by the next, SVB exploded with massive deposits, only to wipe out when massive withdrawals combined with massive interest rate hikes.

Now, federal agencies propose to clean up the damage by guaranteeing uninsured deposits, a signal that these deposits are virtually insured.

8. President Biden signals confidence in banking system.

President Biden briefly addressed the banking issue Monday morning, “Thanks to the quick action of my administration the past few days, America is going to have confidence that the banking system is safe. Your deposits will be there when you need them.”

9. U.S. federal government can do little to boost confidence in banks.

Throughout the 21st century, the U.S. federal government has essentially pledged itself as the backstop for any collapse of the financial sector.

That policy only works so long as the U.S. federal government remains solvent. In a report last month, the Congressional Budget Office projected that the U.S. government will spend more money in interest payments on an ever-growing national debt than on national defense by 2028; it also projected that Social Security will become insolvent in 2033. Meanwhile, a divided Congress is at loggerheads about raising the debt ceiling, which the government hit on January 19, with Democrats and Republicans at odds about whether spending cuts should go along with a debt ceiling increase.

So, it’s worth wondering how much pledges by the U.S. federal government can boost credibility in the banking system. In fact, the latest (2022) Gallup public opinion poll found that a higher percentage of Americans have a “Great deal” or “Quite a lot” of confidence in banks (27%) than in Congress (7%) or the Presidency (23%).

10. Worldly wealth is fleeting, but a Christian can trust in God.

Reading an in-depth explainer about the collapse or tottering of several bank institutions and an emergency response from the federal government has the potential to provoke fear or anxiety in anyone, particularly a person who is cautious by nature. But while there’s room for prudence, a biblical response will not get stuck in that rut.

“No one can serve two masters, for either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve God and money,” Jesus told his followers (Matthew 6:24). Clearly Jesus means that we should serve God instead of money. But what reasons does he give?

Jesus had just said, “Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also” (Matthew 6:19-21). Earthly treasures have a tendency to up and leave.

Proverbs makes the same point, “Do not toil to acquire wealth; be discerning enough to desist. When your eyes light on it, it is gone, for suddenly it sprouts wings, flying like an eagle toward heaven” (Proverbs 23:4-5).

Building your life on worldly wealth is “like a foolish man who built his house on the sand” (Matthew 7:26). It might look just fine while all goes well, but when “the rain fell, and the floods came, and the winds blew and beat against that house,” Jesus said, “it fell, and great was the fall of it” (Matthew 7:27). By contrast, said Jesus, “Everyone then who hears these words of mine and does them will be like a wise man who built his house on the rock,” which “did not fall in the storm, “because it had been founded on the rock” (Matthew 7:24).

Are you trusting your future happiness to a bank’s survival, or to your heavenly Father?

Jesus gives another reason to serve God rather than money: the kindness of God will supply the needs of his children. Consider the birds and the lilies, he said. “If God so clothes the grass of the field, which today is alive and tomorrow is thrown into the oven, will he not much more clothe you?” (Matthew 6:30).

“Therefore,” Jesus applies the lesson, “do not be anxious, saying, ‘What shall we eat?’ or ‘What shall we drink?’ or ‘What shall we wear?’ … Your heavenly Father knows that you need them all. But seek first the kingdom of God and his righteousness, and all these things will be added to you.” (Matthew 6:31-33).

AUTHOR

Joshua Arnold is a staff writer at The Washington Stand.

RELATED ARTICLE: Woke Priorities Borrowed Trouble for Belly-Up Bank

RELATED TWEETS:

WOW… Silicon Valley Bank gave $73,450,000 to “BLM Movement & Related Causes”

— Charlie Kirk (@charliekirk11) March 14, 2023

Newsom Under Fire For Failing to Disclose Personal Ties to Silicon Valley Bank While Lobbying for Bailouthttps://t.co/rojwrzGJUm

— Collin Rugg (@CollinRugg) March 14, 2023

EDITORS NOTE: This Washington Stand column is republished with permission. All rights reserved. ©2023 Family Research Council.

The Washington Stand is Family Research Council’s outlet for news and commentary from a biblical worldview. The Washington Stand is based in Washington, D.C. and is published by FRC, whose mission is to advance faith, family, and freedom in public policy and the culture from a biblical worldview. We invite you to stand with us by partnering with FRC.