Several news stories caught attention in the last few days. One was that Moody, the bond rating agency, joined Standard and Poor’s and Fitch, in downgrading the bond rating of US government debt. It would seem the issuer of the reserve currency of the world, and the world’s largest economy no longer has a AAA credit rating with any of the major bond rating agencies.

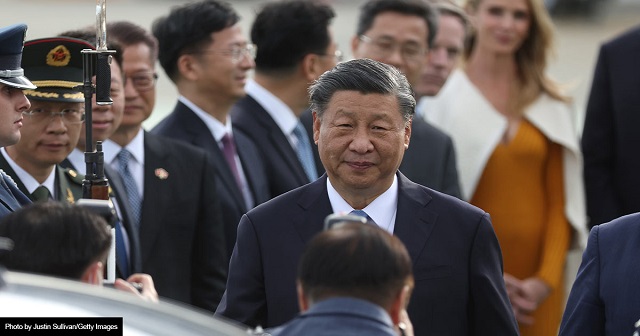

Then two stories appeared in the Wall Street Journal. One was “China’s Economy Descends Back Into Deflation”, and how various government attempts to “stimulate” have failed.

The next day we are treated to “Japan: The Land Where Inflation Is Good News.”

It seems deflationary pressure is now evident in our neighbor Canada.

Bloomberg reports that British inflation has taken its sharpest tumble in 30 years.

So, arguably the second-largest economy in the world, China, is sliding into deflation. The third largest economy in the world, Japan, is trying to get out of deflation. A few other notable countries are starting to deflate.

With the price of everything in the grocery store soaring here in the US, could we too be headed for deflation? After recently buying some cuts of beef and filling up the gas tank, such a thought seems ridiculous.

What is deflation?

Deflation is defined as a decline in prices, often accompanied by a contraction in the supply of money. It is usually associated with a sharp economic contraction, rising unemployment, a credit crisis, and widespread default on debt.

Typically, deflations have been associated with sharp declines in asset prices such as stocks, commodities, and real estate.

There may be even a decline for a while in consumer prices, but they do not tend to be that severe.

Sometimes the episodes are so intense, they can upset the existing monetary order and political order. Some episodes have been related to war or the economic financial strains stemming from financing a war.

Periods of deflation have tended to be episodic both before and since the founding of the Federal Reserve in 1913. The nation suffered short but sharp contractions such as in the Panics of 1819, 1837, 1857, 1873, and 1893, and a big one in 1907, that led to the founding of the FED.

After that, we continued to have episodes of deflation such as the Great Depression of the 1930s and of course the most recent Great Financial Crisis of 2007-2009.

Demographic trends may influence inflation or deflation but opinion on that is divided. The current trend of falling population means fewer consumers, which will drop demand over time, which is deflationary. However, it means fewer workers, which could mean higher labor costs. Demographic skew, meaning an imbalance between older and younger workers can be inflationary because more people must be supported in social entitlements than there are new taxpayers. Likely, demographic trends may aggravate monetary trends already underway.

Advocates of government intervention believe that with enough manipulation of money and credit, and stimulative fiscal policy, the business cycle/credit cycle can be modulated. Bureaucrats and officials have come to believe they can “fine tune” the economy and so has Wall Street.

It is true that the excesses of unemployment seen in previous periods have been avoided, but it is also true that the value of money has taken it on the chin as a consequence. Many people claim that is a fair trade-off. People stay mostly employed but the value of money constantly sinks. Since the founding of the Federal Reserve, the value of the 1914 gold-backed dollar has fallen to about three cents today. That is almost Latin American-like currency depreciation, but it has taken place in slow motion. That said, it is still 97% destruction of purchasing power over about a century.

Is that really a fair trade-off? History is yet to decide but it is clear recent politics favors inflationary outcomes.

Since at least the Asian currency crisis in 1998, through the Dot-Com bubble burst in 1999-2000, and the Great Financial Crisis seven years later, both the US government and the Federal Reserve have been hyperactive bailing out the economy and stopping recessions from taking place.

Some have argued that this constant meddling creates a moral hazard. Financial buccaneers continue their excessive ways precisely because they have been taught to expect bailouts. Citibank for example, has been saved at least four times.

Others say this has created a “Yellowstone effect.” No, this has nothing to do with the popular TV show. It relates to forestry policy pursued in National Parks and forests that forbid logging and concentrated on putting out every small fire that occurred naturally. The net result was the natural fires that cleared out dead and dry underbrush could not occur, and loggers could not take it out either. What happened then was so much dead wood accumulated that fires got so large they simply overwhelmed firefighting capabilities.

An economy is a system not unlike a forest. Financial failure purges the inefficient and poorly managed companies and industries. Like life in general, failure often teaches more than success. If you stop failure from occurring, you get arrogance and excess. Both profit and LOSS are essential to a free enterprise system.

After hyper-intervention policies failed to stop what was called disinflation (mild, persistent deflation), the FED decided they must achieve at least 2% inflation (they were fearful of deflation, remember?). They also seemed to feel some inflation was necessary for growth. You know the story. They got inflation to almost 9% and now it seems stuck around 4%. So much for fine-tuning!

The two main tools to “stimulate” or manipulate the economy have been massive fiscal stimulus (enormous deficit spending) and central bank policies of ZIRP (zero interest rate policies), coupled with QE, or central bank buying of government debt.

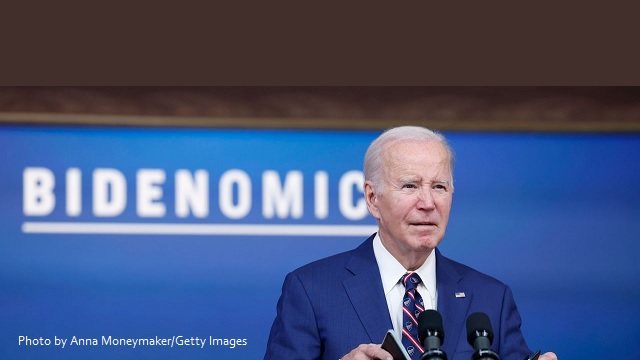

Given the current debt crisis and bond downgrades, neither of these policies seem available should the US slide into recession. Biden and the Democrats have blown out the budget and lowering rates suddenly from here would indicate the FED has caved in on inflation. So, we go into the next contraction portion of the cycle with policy tools hampered by past excess.

There also is a point where going into debt to stimulate consumption and growth hits a limit. At some point, the debt burden becomes so great and can climb exponentially because of the increase in interest rates, that so much money is needed to service debt that there is not much left for savings, investment, and even consumption. Unfortunately, no one knows where that debt burden begins to destroy growth.

The interest owed on the nation’s debt is a function of the size of the deficit to be financed and the interest rate. It has now climbed above $1 TRILLION, more than what the nation pays for defense, and will soon even eclipse what is paid on Social Security. It is in the process of eating the Federal budget.

Interest rates are not entirely controlled by the FED. What worldwide and domestic investors think about the downgrading of the debt’s quality and the prospect of being paid off with inflation, also is a factor.

Interest on the debt now absorbs a little over 40% of all tax revenue collected. Since money in the Federal budget is fungible, we are now borrowing money, to pay the interest, creating a “doom loop.”

That is the problem, and that is why investors need to at least think about the possibility of deflation. It has happened before in our history and it is currently starting in our biggest trading partners.

Governments seem to have an easier time fighting inflation than fighting deflation and that is partly why the FED felt it necessary to get inflation going.

There is an old saying among central bankers: you can’t push on a string. You can deny or contract credit by raising rates in the fight against inflation (pulling the string), but you can’t make people borrow if they are busy contracting their businesses or are already up to their necks in debt (pushing the string).

Given their track record of failure, why would reasonable people believe the FED and our government could prevent deflation? Well, they do and the majority view is they will pull off a “soft landing.”

At the end of the day, there are only three ways to deal with debt. You can pay it down (economic austerity), you can refinance it, or you can default on it.

The Federal Government has one other option not available to the private sector. That would be an attempt to inflate the debt away through currency depreciation. We would say trying to inflate the value of debt away, is also a form of default.

Debt must be serviced with income. The problem is society takes long-term obligations in debt with no assurance the cash flows will always be there to support the debt. If the economy slows down, income falls but the debt stays on the books. If you can’t pay or refinance, then default can spread much like a forest fire.

Austerity is very unpopular politically because people like to spend and government loves to spend.

Refinancing the debt is possible, but with interest rates so much higher than they were just a few years ago, it is painfully expensive to do so. Janet Yellen, former head of the FED and now Secretary of the Treasury, will go down as one of the greatest boneheads in financial history. While every sentient homeowner in the country was refinancing their long-term debt with mortgages at 3%, she failed to refinance hardly any of the US accumulated deficits when rates hovered above zero.

Default is an option but it can be extremely painful. One man’s debt is another man’s asset. If you don’t pay your debt, the bank, the mortgage company, and investors who finance either or both, have to take the loss. It is because of this reality that debt default can cause economic depression.

In international terms, a US default would implode the reserve assets (US dollar bonds) of the international banking system, spreading the pain globally.

Deflations are the most likely when there has been wild excess in the system. Again, our forest analogy is helpful. After a number of extremely wet years, underbrush can grow rapidly. Then the weather turns dry and the forest is now vulnerable.

We all know about the huge increase in both government debt and the rising cost of maintaining it at higher rates. Yet both political parties seem unable to stop spending.

There is now talk of a bi-partisan commission to deal with the debt, much like the Congressional committee that was successfully used to implement military base closings. But the Congress is so divided, and the problem is now so advanced in nature, that it is doubtful it will occur in time to head off a crisis. Indeed, the crisis itself likely will be the stimulant to re-order the way Congress has been spending money.

But excess is also in the private sector. As the Kobeissi Letter recently pointed out:

“The U.S. Now Has:

- Record $17.29 trillion in household debt

- Record $12.14 trillion in mortgages

- Record $1.60 trillion in auto loans

- Record $1.08 trillion in credit card debt

Total mortgage debt is now more than double the 2006 peak and mortgage rates are nearly 1.5% higher than the 2008 peak.

Meanwhile, student loan payments just resumed for the first time since the pandemic with an average payment of $500/month. This is all while new car loan rates are at a record 10% and credit card debt rates hit a record 25%.”

In short, the period of zero interest rates led most people and the government to use excessive amounts of debt because capital was virtually free.

If the economy slows down, where is the additional income going to come from to service this huge expanding debt bubble?

The real test will come in the next year or so. Many traditional signs of recession are now starting to appear. Main Street and Wall Street naively ignore these signs because, to date, unemployment remains very low. However, that is not the ONLY indicator to watch.

Among the indicators concerning us are: a long period of yield curve inversion that is now de-inverting, sharply rising interest rates, a significant rise in corporate bankruptcies (up 30% from last year), a drop in the money supply, a sharp drop in bank lending, weak commodity prices outside of oil, a very sharp drop in international maritime shipping rates, a rise in unemployment above its one-year average, a sharp decline in government revenue, severe weakness in commercial real estate, stagnation in residential real estate, and severe weakness in our major trading partners Germany, Japan, and China.

The question then becomes this: when and if the recession hits, how likely is it to unleash deflationary forces in the US?

We think it is a higher probability than most people think. Recessions have not been eliminated by the government. Quite to the contrary, by blowing a series of financial asset bubbles, they have built up enough dead wood for one hell of a fire.

Recently, we turned more positive on the stock market, suggesting the weakness would be over by early November. The stock market was badly oversold and due to bounce into the seasonal strength typical this time of year. The threat of deflation and a rising market at first seem contradictory. They are not. In the short term, the stock market is not directly connected to the economy. A hint of a slowdown means relaxation of interest rates, which is short-term bullish. However, that does not change the grave financial condition in both the public and private sector which could be exacerbated by a recession.

TAKE ACTION

As we move through 2023 and into the next election cycle, The Prickly Pear will resume Take Action recommendations and information.