Biden’s Demagoguery That Government Spending is Costless

There is only one way to describe the fiscal mindset of those in the White House and in Congress who are proposing new federal budgetary expenditure and taxing increases in the trillions of dollars: a fantasy land of financial irrationality.

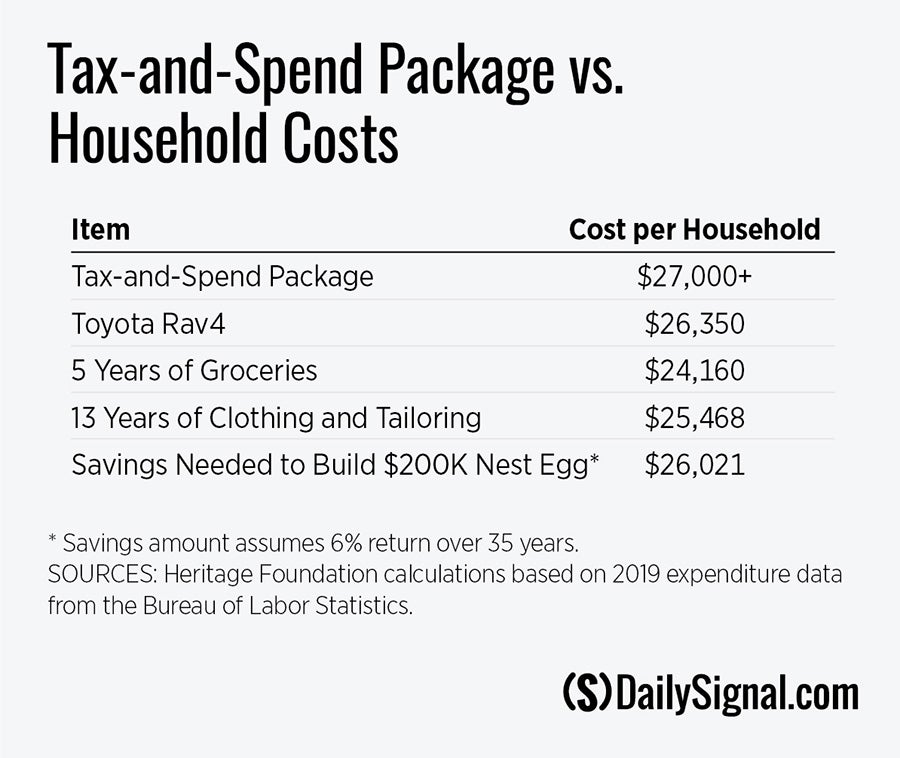

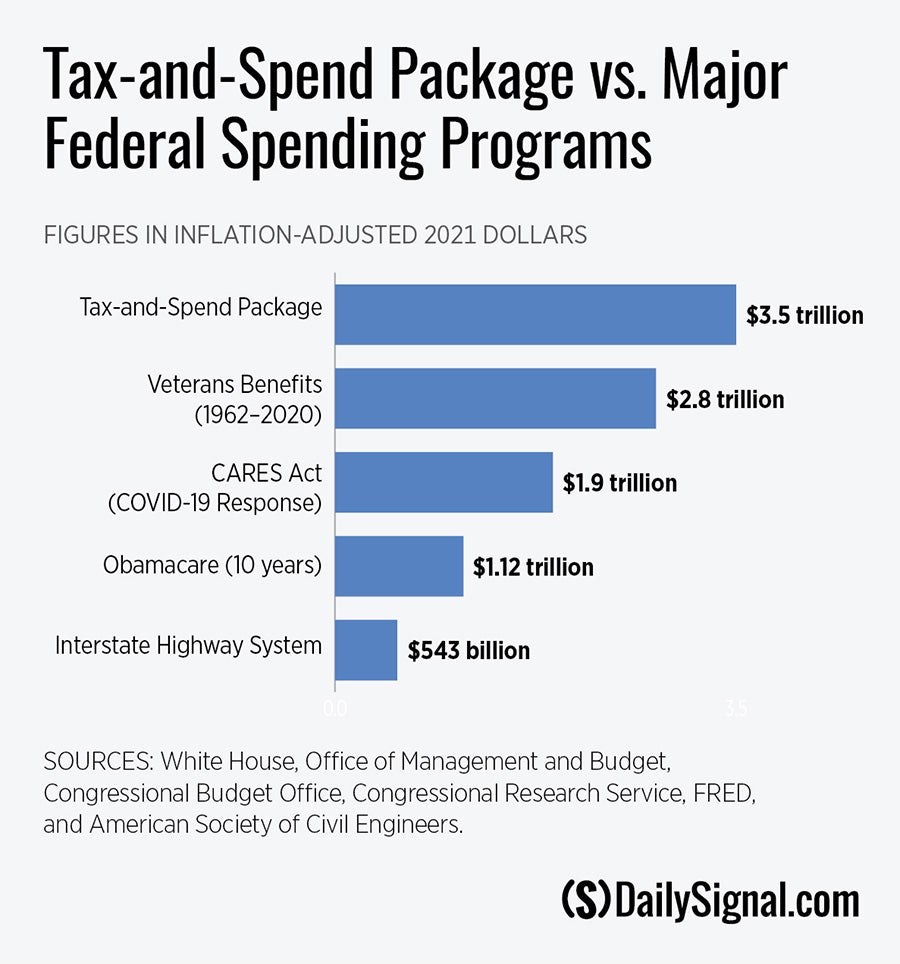

The Biden Administration insists on additions to the already bloated American welfare state that will see an expansion in entitlement programs and increased societal dependency on government largess not implemented since Lyndon Johnson’s Great Society programs of the 1960s. But to show just how much Joe Biden’s mind seems to operate in some alternate universe, he has recently informed us that the $3.5 trillion of additional government spending over the next several years will cost “nothing.”

Why, nothing? Because over $2.1 trillion will be covered by taxing the rich and large corporations. The remaining difference between $3.5 trillion of greater spending and $2.1 trillion of increased taxes will materialize through some magic formula of government investing in infrastructure, alternative energy sources, and people.

Biden’s Hucksterism of Something for Nothing

Notice the rhetorical hucksterism. All of that additional spending won’t cost anything, because “you” are not being taxed to pay for it, and it will not result in any net increase in the national debt. It’s those others, you know, the millionaires and billionaires, who neither need all that money nor deserve it. You do, in the form of increased government redistribution.

You see, if you are not taxed to pay for it, and if it does not increase the debt, it is all, well, free goodies with other people’s money, other people who really don’t count or matter. How else do we interpret Joe Biden’s words at a recent White House event? “It is zero price tag,” he said, “on the debt we’re paying. We’re going to pay for everything we spend.” He went on to say, “Every time I hear this is going to cost A, B, C, D – the truth is, based on a commitment that I made, it’s going to cost nothing . . . because we are going to raise the revenue.”

This was clarified by White House deputy press secretary Andrew Bates, “The bill’s price tag is $0 because it will be paid for by ending failed, special tax giveaways for the richest taxpayers and big corporations,” he said, “adding nothing to the debt.” Listening to the president and those around him, you would assume that “the rich” pay little or nothing, while the poor and the middle-class working population bear the brunt of all the good things that government paternalism does for all of us.

Those Who Bear the Tax Burden for Government Spending

In fact, in 2018, the top 1 percent of income earners (those earning $540,000 or more) paid more than 40 percent of all income taxes collected; the top 5 percent of income earners (those making $218,000 or more) paid 60.3 percent of all collected income taxes; the top 10 percent (those earning $152,000 or more) paid 71.4 percent of all income taxes; and the top 25 percent (those making $87,000 or more) paid 87 percent of all income taxes paid. The bottom 50 percent of all income earners (those earning $43,600 or less) paid less than 3 percent of all income taxes collected.

As for corporate taxes, the United States, currently, ranks as 13th in heavily taxing corporations, but if Biden’s tax plan were to be implemented, the corporate tax rate would rise from 21 percent to 26.5 percent at the federal level. But considering that state governments also tax corporations, these business enterprises would (depending on the state) have taxes anywhere between 30 percent and 35 percent. If this happens, the U.S, would rank third in the world in terms of corporate taxes, just behind Portugal and Columbia.

In a new study, economists Daniel Mitchell and Robert P. O’Quinn estimated that the business tax effects of Biden’s plan would shift about 2 percent of the economy’s output into the hands of the government over several years, with an appreciable negative impact on private sector economic growth looking to the years ahead. They estimate a $3 trillion shortfall in national income from what it otherwise might have been over the next decade if Biden’s policies were not implemented.

A Philosophy of Plunder, Envy, and Paternalism

What is as disturbing as the possible economic impacts of these spending and taxing policies is the philosophy behind them. From Biden’s own mouth, the largess coming from government can be viewed as costless for those said to be the interest group beneficiaries, only as long as someone else can be made to pay the fiscal tab for it. This is an out-and-out politics of plunder, under which people may be promised practically anything, because the rich Peter will be taxed for the benefit of the deserving Paul.

The political paternalists always insist that those they designate as the rich do not really deserve or have a right to their higher incomes and wealth. First, this is because of the clear envy hidden behind the smokescreen of convoluted conceptions of equality. The mere having of more than others becomes a mark of social injustice.

Second, underlying this are forms of the Marxian and socialist presumptions that accumulated wealth and high income can have no origin other than by the exploitation and the oppression of others. If some have significantly more than others, there can be no rational reason for it other than it represents ill-gotten gains taken from others to whom it legitimately belongs. As a consequence, taking more of it away from the rich is merely – through the intermediation of the redistributing political authority – getting back what is rightfully due to those from whom it should never have been stolen in the first place under the capitalist system.

The only modern variation on this theme is that social classes in conflict with one another have been widened to incorporate a white, male, capitalist exploitation and oppression of all people of color, and female and related genders, along with the workers of all ethnicities and races. (See my article, “Identity Politics and Systemic Racism Theory as the New Marxo-Nazism”.)

Biden’s Socialism is of the Fascist Variation

It is noteworthy that when democratic socialists like Bernie Sanders or Alexandria Ocasio-Cortez are asked how much would be enough for the capitalist rich to pay their “fair share,” there is never a truly straight answer, other than implicitly a number approaching 100 percent. Biden, of course, has gone out of his way to insist that he is not a socialist.

But when your starting premise is that all good things come only through government planning, directing, and dictating, and that the resources and wealth of the entire country are at the discretionary disposal of those in political power who think like him, it is difficult not to view Biden as a central planner. And when central planning takes the form of government directly or indirectly commanding how those who own private businesses may go about their business in terms of what, how, where, and when to produce, employ, sell, and price what is being offered for sale, we end up with fascism.

When a president of the United States declares that he will use every political power at his disposal to compel as many people as possible to be vaccinated against a virus; when he insists that good citizenship requires every American to wear a facial mask, and pressures businesses to impose vaccine and masking rules on virtually every working American; when he commands that within a handful of years the majority of vehicles on the roads and highways of America must be powered and fueled a certain way, and threatens penalties if auto manufacturers do not comply with this demand; when he imposes retroactive regulatory rules and prohibitions on various forms of enterprise structures and market conduct through active antitrust enforcement; when he does these, and dozens more in a matter of a few months that he has been in office, one is reminded of Benito Mussolini’s description of the fascist, totalitarian system: “All within the state, nothing outside the state, nothing against the state.”

Biden Gets Arrogantly Impatient with a World Not Obeying Him

Biden always seems impatient whenever he is challenged about any of his decisions. He angrily turns away from any more questions about the American withdrawal from the Afghanistan debacle. He has no intention of rethinking the pilotless drone warfare that enables the United States to arrogantly target anyone, anywhere in the world. He seems to believe that just about everything is in America’s national interest.

He knows the world is threatened by global warming, so he will try to remake how all Americans live and work, and he is closed to any suggestion that the supposed science is challengeable. He talks like an irritated, impatient parent who is tired of the foolishness of the immature child-like citizens who won’t do as they are told. He hides away and won’t even talk about a border crisis of his own making.

Why, then, should it be surprising that Joe Biden just announced that $3.5 trillion of additional paternalist government spending has no cost? If he says so, well, then it is true. It is costless because it will not increase the national debt, since it will be paid for by imposing $2.1 trillion of higher taxes on those designated as rich, and taxing them, remember, has no cost attached to it.

Notice that in Joe Biden’s fiscal world, there are no trade-offs between the use of scarce resources in the private sector versus and by government. Indeed, magically, resources in the government’s hands are somehow automatically more productive. How else can it be asserted that taxing the rich an additional $2.1 trillion will somehow equal $3.5 trillion of redistributive spending?

Ludwig von Mises on the Illogic of Government Spending and Taxing

The mindset behind such policies are, tragically, nothing new. More than 90 years ago, in 1930, the Austrian economist, Ludwig von Mises (1881-1973), wrote about a similar mentality in his native Austria in the years between the two World Wars. Mises was at that time employed as a senior economic policy analyst for the Vienna Chamber of Commerce, Crafts, and Industry. In that capacity, he had a wide and detailed knowledge of the fiscal and regulatory policies of the Austrian government.

Mises delivered a talk before the Industrial Club of Vienna in December 1930 on “Adjusting Public Expenditures to the Economy’s Financial Capacity,” (Chapter 26) in which he discussed the mentality seen in the open in Washington, D.C. today. It is, perhaps, worthwhile, therefore, to quote Mises at some length:

“The errors in our fiscal policy stem from the theoretical misconceptions that dominate public opinion about financial matters. The worst of these misconceptions is the famous, and unfortunately undefeated, idea that the main difference between the state’s and the private sector’s budget is that in the private sector’s budget expenditures have to be based on revenues, while in the public sector’s budget it is the reverse, i.e., the revenue raised must be based on the level of expenditures desired.

“The illogic of this sentence is evident as soon as it is thought through. There is always a rigid limit of expenditures, namely the scarcity of means. If the means were unlimited, then it would be difficult to understand why expenses should ever have to be curbed. If in the case of the public budget it is assumed that its revenues are based on its expenditures and not the other way around, i.e., that is expenses have to be based on its revenues, the result is the tremendous squandering that characterizes our fiscal policy.

“The supporters of this principle are so shortsighted that they do not see that it is necessary, when comparing the level of public expenditures with the budgetary expenditures of the private sector, not to ignore the fact that enterprises cannot undertake investments when the required funds are used up instead for public purposes. They only see the benefits resulting from the public expenditures and not the harm the taxing inflicts on the other parts of the national economy . . .

“When the taxation of enterprises goes too far, it results in the consumption of capital. To a large extent, this has been the case here in Austria for the last eighteen years. Capital consumption is detrimental not only for the owners of property but for the worker as well. The more unfavorable becomes the quantitative ratio of capital to labor, the lower is the marginal productivity of the work force, and, consequently, the lower are the wages that can be paid.

“The view that levying taxes on property in any amount does not affect the interests of the masses is just one of the steps leading to the demagogic and false doctrine that it is safe to burden the state with any amount of costs.”

Fiscal Follies Can Lead to Capital Consumption

The following year Mises co-authored a report for the Austrian government that demonstrated that between 1925 and 1929, tax increases and compulsory union wage demands on the Austrian private sector had actually resulted in capital consumption. Private enterprises were unable to maintain the value and physical capacity of their capital. General corporate business taxes were increased by 32 percent, mandatory social insurance payments rose by 50 percent, industrial wages, in general, had been pushed up by 24 percent, and wages in agriculture by 13 percent, along with higher transportation costs by 15 percent due to various regulatory interventions.

At the same time, an index of the prices of manufactured goods bearing these fiscal and labor union burdens had increased only by 4.74 percent. For many segments of the Austrian economy, revenues were not enough to cover the costs of maintaining capital. Austrian society became economically poorer, as a result.

The difficulty of fully appreciating how fiscal and related policies can lead to such an extreme situation was also something that Ludwig von Mises drew attention to. Near the end of his famous treatise on Socialism: An Economic and Sociological Analysis, he explained:

“Capital consumption can be detected statistically and can be conceived intellectually, but it is not obvious to everyone. To see the weakness of a policy which raises the consumption of the masses at the cost of existing capital wealth, and thus sacrifices the future to the present, and to recognize the nature of this policy, requires deeper insight than that vouchsafed to statesmen and politicians or to the masses who have put them into power.

“As long as the walls of the factory buildings stand, and the trains continue to run, it is supposed that all is well with the world. The increasing difficulties of maintaining the higher standard of living are ascribed to various causes, but never to the fact that a policy of capital consumption is being followed.”

Biden’s Policies Could Lead America Down the Same Road

America may still be far from a situation in which its capital is consumed in the manner that Mises analyzed. But it nevertheless remains that the political and ideological forces at work are not that much different from his time in interwar Austria. Taxing the rich is presumed to have no detrimental effect on the continuing maintenance and increase in the capital that enables more, better, and newer products from coming to the market. We know this because Joe Biden has told us so. The same presumption is made in our time as in Mises’s. More government spending in any and all directions need not be limited to available resources.

Government borrowing and Federal Reserve money-printing are presumed to have no cost or constraint. All you need is a central bank that is willing to keep interest rates near zero, so the cost of borrowing trillions to cover budget deficits can seem to be almost nothing at all. There is always enough fiat money in the banking system to make it seem like there is plenty for anyone and everyone, for almost anything.

Joe Biden’s demagoguery, arrogant impatience, and dictatorial manner do not and cannot change reality. At the end of the day, his policies can only lead to a financial and economic disaster. But why should he care? He gets to sit in the Oval Office, play master of the world, have his staff and supporters bow and grovel at his feet, and dream of his legacy as president of the United States.

Besides, at 78 years of age, most of the disastrous consequences of his own policies will only fully come home to roost after he is long gone. Those will be some other president’s problem. For now, he gets to play the most powerful political paternalist on the planet. As for later, well, Après nous le deluge.

*****

This article was published on September 30, 2021, and is reproduced with permission from AIER, American Institute for Economic Research.