RINO ALERT: LIST Of 11 Republicans Who Voted With Democrats To Raise the Debt Ceiling by $480 Billion

By Pamela Geller

“Compromise is the art of losing slowly.” – LTC Rich Swier, U.S. Army (Ret.)

Stop donating to the RNC. Stop supporting the party that never misses an opportunity to stab us in the back.

BY: Noah, WLT, October 8, 2021:

RINO alert!

How much more are we going to take folks?

We all know Mitch McConnell has repeatedly sold out America over and over and over again — someone should look into the situation with his wife….

And we know it often feels like there are more RINOs that Republicans with a spine and a brain.

Way more.

I am very sad to report 11 Republicans once again just sold us out.

Sold out you, me and America.

And our future.

Under NO circumstances should we have raised this debt ceiling!

Let the Biden Regime FALL under its own weight!

Let it be crushed under its own money printing!

Why are we raising their limit?

Does that make sense to anyone?

I guess it did to these 11 RINOs…..

BREAKING: 11 Republicans have just voted with Democrats to raise the debt ceiling.

This should NOT be so damn hard.

— BrooklynDad_Defiant! (@mmpadellan) October 8, 2021

61-38: Senate ends a filibuster against increasing the debt ceiling by $480 billion to December 3rd. 60 votes were needed.

11 Republicans Blunt Barrasso Capito Collins Cornyn McConnell Murkowski Portman Rounds Shelby and Thune voted Yes with all Democrats. Burr did not vote. pic.twitter.com/X0F98EMj4Y

— Craig Caplan (@CraigCaplan) October 8, 2021

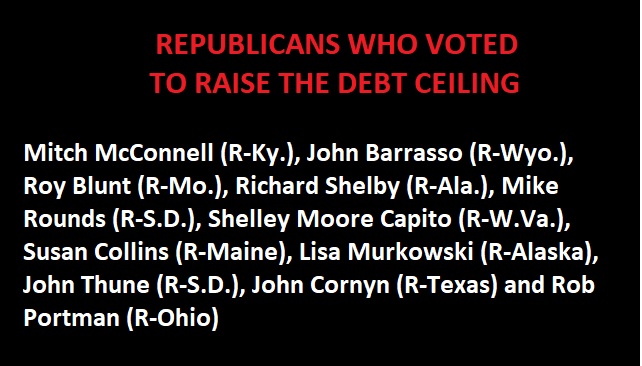

And here is the list:

🚨 11 Senate Republicans vote YES, along with 50 Democrats, to break a filibuster and hold a final vote on the short-term debt limit deal

Barrasso

Blunt

Capito

Collins

Cornyn

McConnell

Murkowsk

Portman

Rounds

Shelby

ThuneThe vote succeeds 61-38.

— Sahil Kapur (@sahilkapur) October 8, 2021

Make those names famous and VOTE THEM OUT!

Write them down.

Remember them.

Vote them out.

Here’s more from Politico:

Here are the Senate Republicans who walked the plank: Mitch McConnell (R-Ky.), John Barrasso (R-Wyo.), Roy Blunt (R-Mo.), Richard Shelby (R-Ala.), Mike Rounds (R-S.D.), Shelley Moore Capito (R-W.Va.), Susan Collins (R-Maine), Lisa Murkowski (R-Alaska), John Thune (R-S.D.), John Cornyn (R-Texas) and Rob Portman (R-Ohio) all voted in favor of cloture. None are expected to vote for final passage.

Next steps: Senators move onto final passage of the bill that would raise the debt ceiling through early December. It needs just a simple majority, and Vice President Kamala Harris is expected to swoop in to break the tie.

And from Mediaite:

Enough Republicans joined Democrats on a procedural vote Thursday night to advance the debt ceiling deal, 61-38.

60 votes are needed to overcome the filibuster, and Senate Minority Leader Mitch McConnell was one of 10 Republicans who voted to proceed.

In addition to McConnell, Senate Minority Whip John Thune, Senator John Cornyn, Senator Lisa Murkowski, Senator Susan Collins, Senator Richard Shelby, Senator Rob Portman, Senator John Barrasso, Senator Shelley Moore Capito, Senator Roy Blunt, and Senator Mike Rounds voted to advance the measure.

NATIONAL POLL: Would You Like To See “The Squad” Voted Out of Office?

The deal itself will be voted on later and is expected to pass.

Some Republicans were publicly critical of McConnell before the vote. Ted Cruz and Lindsey Graham slammed him for caving.

Your thoughts?

VOTE THE TURTLE MAN OUT!

To be clear, Mitch McConnell looks…..like…..a turtle.

But he votes like a RINO.

Make those names famous and VOTE THEM OUT!

Write them down.

Remember them.

Vote them out.

Here’s more from Politico:

Here are the Senate Republicans who walked the plank: Mitch McConnell (R-Ky.), John Barrasso (R-Wyo.), Roy Blunt (R-Mo.), Richard Shelby (R-Ala.), Mike Rounds (R-S.D.), Shelley Moore Capito (R-W.Va.), Susan Collins (R-Maine), Lisa Murkowski (R-Alaska), John Thune (R-S.D.), John Cornyn (R-Texas) and Rob Portman (R-Ohio) all voted in favor of cloture. None are expected to vote for final passage.

Next steps: Senators move onto final passage of the bill that would raise the debt ceiling through early December. It needs just a simple majority, and Vice President Kamala Harris is expected to swoop in to break the tie.

And from Mediaite:

Enough Republicans joined Democrats on a procedural vote Thursday night to advance the debt ceiling deal, 61-38.

60 votes are needed to overcome the filibuster, and Senate Minority Leader Mitch McConnell was one of 10 Republicans who voted to proceed.

In addition to McConnell, Senate Minority Whip John Thune, Senator John Cornyn, Senator Lisa Murkowski, Senator Susan Collins, Senator Richard Shelby, Senator Rob Portman, Senator John Barrasso, Senator Shelley Moore Capito, Senator Roy Blunt, and Senator Mike Rounds voted to advance the measure.

NATIONAL POLL: Would You Like To See “The Squad” Voted Out of Office?

The deal itself will be voted on later and is expected to pass.

Some Republicans were publicly critical of McConnell before the vote. Ted Cruz and Lindsey Graham slammed him for caving.

Your thoughts?

VOTE THE TURTLE MAN OUT!

To be clear, Mitch McConnell looks…..like…..a turtle.

But he votes like a RINO.

EDITORS NOTE: This Geller Report column is republished with permission. ©All rights reserved.

Quick note: Tech giants are shutting us down. You know this. Twitter, LinkedIn, Google Adsense, Pinterest permanently banned us. Facebook, Google search et al have shadow-banned, suspended and deleted us from your news feeds. They are disappearing us. But we are here. We will not waver. We will not tire. We will not falter, and we will not fail. Freedom will prevail.

Subscribe to Geller Report newsletter here — it’s free and it’s critical NOW when informed decision making and opinion is essential to America’s survival. Share our posts on your social channels and with your email contacts. Fight the great fight.

Remember, YOU make the work possible. If you can, please contribute to Geller Report.