Even Newsweek Can’t Ignore Immigration Crisis On Southern Border

A first step, hopefully, in reporting the truth?

On May 13, 2021 Newsweek published an interesting article about an element of the immigration crisis, Asylum Seekers Dropped Off by Border Patrol Strain Resources of Arizona Border Towns.

Apparently even a leftist publication like Newsweek can no longer ignore the crisis on the southern border that was exponentially exacerbated by executive orders and policies of the Biden administration that have reversed many of the most successful policies and actions of the Trump administration that include the construction of the hotly contested border wall, the “Remain in Mexico” policy for aliens applying for political asylum and the curtailment of most immigration law enforcement activities carried out within the interior of the United States, essentially ordering beleaguered agents of ICE (Immigration and Customs Enforcement) to stand down.

The Newsweek article, however, focused exclusively on the impact this human tsunami is having on small border town in the United States that lie along the U.S./Mexican border that are being overwhelmed by crush of aliens and on how this impacts the aliens.

However, what must also be recognized is how this immigration crisis impacts the residents of these cities and their residents who have become the unwitting victims of the Biden immigration crisis. (I believe in giving credit where credit is due!)

Of course the impact of illegal immigration may be most obvious in the numerous towns and cities that lie along the dangerous and highly problematic U.S./Mexican border but there are two additional issues that are largely being ignored by the complaint mainstream media so that most Americans still do not understand the profound impact that illegal immigration has on towns and cities across our vast nation.

First of all, most illegal aliens do not remain in those so-called “border towns” and “border cities” but quickly head to towns and cities across the entire United States.

Back in the late 1970’s When I was assigned to the Anti-Smuggling Unit at the New York District Office of the former INS my colleagues and I conducted surveillance of airline flights from the four states that lie along the southern U.S. border, particularly the “Red eye flights” so named because they flew during the night, carrying bleary-eyed passengers.

We frequently encountered illegal aliens who had boarded those airliners shortly after running the southern border. Some of them were still wearing their filthy, mud-encrusted boots and clothing. Not all of these illegal aliens were from Mexico or even from Central America. Some came from countries from around the world.

Second – we are a nation of not four but fifty “border states.” Any state that lies along the northern as well as the southern borders are “border states” as are those states that have access to America’s 95,000 miles of coastline. Finally, any state that has an international airport is also a “border state.”

For decades the open borders crowd maliciously and falsely castigated advocates for border security and effective but fair immigration law enforcement by referring to them as being “Anti-Immigrant,” “xenophobes,” “racists” and “haters.”

Our immigration laws make absolutely no distinction about race, religion or ethnicity or that the purpose of our immigration laws is to prevent the entry and continued presence of aliens who pose a threat to public health, national security, public safety and the jobs and wages of Americans.

A review of 8 U.S. Code § 1182, a section of the Immigration and Nationality Act (INA), will readily confirm the importance and reasonableness of the purpose of our immigration laws, it enumerates the categories of aliens who are statutorily inadmissible.

There is nothing “Anti-Immigrant” about seeking to prevent criminals, terrorists or others who pose a threat from entering the United States just as it is not “Anti-Social” to be careful about who we allow into our homes.

While immigration has traditionally been portrayed as a single issue, in reality immigration is a singular issue that profoundly impacts nearly every challenge and threat facing America and Americans in this particularly difficult and, indeed, perilous era.

What is rarely, if ever reported, is how, ultimately, the flood of aliens into the United States impacts towns and cities across the entire United States undermining national security, public safety, public health and the jobs and wages of Americans while also having a negative impact on healthcare, education and other critical issues, not just for the hapless residents of the border towns discussed in the Newsweek article, but in towns and cities across the United States.

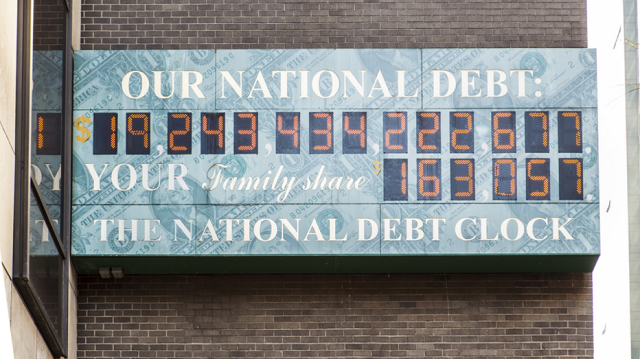

For example, in December 2007 the Congressional Budget Office (CBO) issued a report, The Impact of Unauthorized Immigrants on the Budgets of State and Local Governments that noted:

In terms of public education, unauthorized immigrants who are minors increase the overall number of students attending public schools, and they may also require more educational services than do native-born children because of a lack of proficiency in English. Analyses from several states indicate that the costs of educating students who did not speak English fluently were 20 percent to 40 percent higher than the costs incurred for native-born students.

Consider the impact that a torrent of foreign students has on the education of American children, particularly when many of these foreign students lack English language proficiency.

Schools are forced to spend more money to not only educate these foreign children but also provide special services such English as a Second Language training, thus cutting funding for other vital necessities such as Early Intervention and various therapists for children with learning disabilities. Less money will be available for providing quality education for the students of American schools by, for example, upgrading labs, computers and other essential equipment and resources for American children who have already spent a hellish lost year as a result of the COVID-19 Pandemic that denied them access to their schools.

This, of course is never discussed in the media or by most politicians who, having taken campaign contributions from globalist organizations such as the U.S. Chamber of Commerce are literally and figuratively indebted to those globalist entities.

Interior enforcement of our immigration laws is a critical element of what should be a coherent immigration program to enforce our laws and also to deter massive illegal immigration as I touched on briefly at the beginning of my commentary today.

As I noted in my recent article, Interior Enforcement And The Border Crisis:

On February 18, 2021 the Washington Post reported that a “Biden memo for ICE officers points to fewer deportations and strict oversight.” According to the Post, ICE agents “will need preapproval from a senior manager before trying to deport anyone who is not a recent border crosser, a national security threat or a criminal offender with an aggravated-felony conviction.” The Biden administration expects this policy “to result in a steep drop in immigration arrests and deportations.”

In other words, with a mere stroke of his pen, Biden has virtually eliminated the statutory authority that ICE agents have to make warrantless arrests of suspected illegal aliens. This sends a clear message to the agents, that anything they do can (and likely will) be used against them.

Furthermore so-called “sanctuary” policies implemented by numerous mayors and even some governors further undermine any remaining vestiges of interior enforcement and hence undermine national security and public safety. Sanctuary states now provide driver’s licenses to illegal aliens. New York state even went so far as to block ICE and Border Patrol access to its DMV database, Cuomo’s gift to ISIS, the drug cartels, and human traffickers.

As these hundreds of thousands of aliens are dispersed across the United States they will have little to fear if they fail to show up for immigration hearings. Under Biden’s Executive Orders, illegal aliens may not be arrested unless there is an outstanding warrant for that alien and he/she has an extensive criminal history.

Not all of these aliens are from Latin America. A significant number have come from countries fro around the world, including countries that have known affiliation with terrorism. It is likely that among these aliens are criminals, fugitives, gang members and terrorists.

Meanwhile, while the Border Patrol is hamstrung caring for alien children, many aliens are evading the Border Patrol altogether and are so-called “Get Aways.” There is absolutely no way of knowing who they are, where they are from, where they are headed or what their ultimate goals are. This creates a national security / public safety nightmare.

The official report, 9/11 and Terrorist Travel – Staff Report of the National Commission on Terrorist Attacks Upon the United States provided this warning on page 98 under the title Immigration Benefits:

Terrorists in the 1990s, as well as the September 11 hijackers, needed to find a way to stay in or embed themselves in the United States if their operational plans were to come to fruition. As already discussed, this could be accomplished legally by marrying an American citizen, achieving temporary worker status, or applying for asylum after entering. In many cases, the act of filing for an immigration benefit sufficed to permit the alien to remain in the country until the petition was adjudicated. Terrorists were free to conduct surveillance, coordinate operations, obtain and receive funding, go to school and learn English, make contacts in the United States, acquire necessary materials, and execute an attack.

Perhaps now that Newsweek has been forced to begin to report on the immigration crisis, other supposed news organizations will follow and hopefully look further than the southern border.

The Ministry of Truth was a key element of Orwell’s novel 1984 – but it has no place in the United States of America.

©Michael Cutler. All rights reserved.