President Trump Signs Coronavirus Relief Bill Invoking 1974 Impoundment Control Act to Demand “Rescissions”

The President on Sunday invoked the 1974 Impoundment Control Act to demand “rescissions” be made to the spending measures.

Trump: I will send back to Congress a redlined version, item by item, accompanied by the formal rescission request to Congress insisting that those funds be removed from the bill.

Trump negotiated:

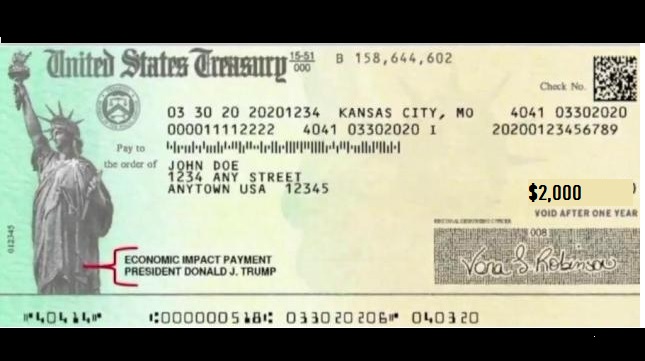

- $2,000 per person

- Section 230 eliminated or substantially revised

- A line by line removal of the pork from the bill

https://twitter.com/KelemenCari/status/1343371877872500737?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1343371877872500737%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fgellerreport.com%2F2020%2F12%2Fpresident-trump-signs-coronavirus-relief-bill-invoking-1974-impoundment-control-act-to-demand-rescissions.html%2F

Trump signs coronavirus relief bill after days of tension

By Tom Howell Jr. – The Washington Times – Sunday, December 27, 2020

President Trump signed the massive coronavirus relief and government spending bill Sunday, ending nearly a week of suspense that flustered governors and lawmakers of both parties.

Mr. Trump put pen to paper after a Christmas period marked by anger and confusion over his demands for bigger payments than what his Treasury secretary and GOP leaders agreed to in intense talks earlier this month.

“As president, I have told Congress that I want far less wasteful spending and more money going to the American people in the form of $2,000 checks per adult and $600 per child,” Mr. Trump said.

He also said he will send Congress a list of “rescissions,” or wasteful budget items that he wants removed, and that Senate Republicans will “start the process” that provides for $2,000 stimulus checks — a provision the House Democratic majority already agreed to.

He said his Senate allies will go a step further and consider repealing the liability protections that shield social media from lawsuits over their content and the voter fraud allegations that he’s pointed to as the reason for his election loss.

John Soloman’s take:

Trump averts shutdown, signs $2.3 trillion spending and COVID relief bill

Trump had refused to sign a Covid relief bill until Congress raised the amount of money paid to everyday Americans.

Updated: December 28, 2020:

President Trump on Sunday night signed a $2.3 trillion federal spending and COVID relief bill, averting a government shutdown and ensuring millions of Americans continue to get unemployment benefits.

Despite his misgivings about wasteful spending and low stimulus payments in the bill, Trump said he signed the legislation because “I have an obligation to protect the people of our country“ from further economic devastation. He said, however, “more money is coming” as Congress votes this week on larger checks.

The president on Sunday also invoked the 1974 Impoundment Control Act to demand “rescissions” be made to the spending measures. Under the Act, a president can seek congressional approval to rescind funds by sending a special message to Congress identifying the amount he proposes to cut, the reasons for it, and the economic impact.

“I will sign the Omnibus and Covid package with a strong message that makes clear to Congress that wasteful items need to be removed. I will send back to Congress a redlined version, item by item, accompanied by the formal rescission request to Congress insisting that those funds be removed from the bill,” Trump said.

The signing came after Trump tweeted, “Good news on Covid Relief Bill. Information to follow!”

The signing brought hope to millions of Americans who lost jobless benefits over the weekend as a federal shutdown loomed.

The standoff occurred after Trump refused before Christmas to sign the $2.3 trillion spending and COVID relief bill, demanding more money for everyday Americans.

Congress failed to address the president’s demands to increase the $600 stimulus checks to $2,000 per person.

RELATED TWEET:

I don't want $600.

I don't want $2,000.I want businesses open. I want people working. I want society back.

— Sydney Watson (@SydneyLWatson) December 29, 2020

EDITORS NOTE: This Geller Report column is republished with permission. ©All rights reserved.