Book Review: The Great Demographic Reversal by Charles Goodhart and Manoj Pradhan. Published by Palgrave/Macmillan 2020

Economics has been referred to as the dismal science. In this book, the former chair of Banking and Finance at the London School of Economics (Goodhart) and the former head of Morgan Stanley International (Pradhan), show once again that economics can indeed be depressing. That said, it is an important book for investors and policymakers alike.

To start, the reader should appreciate that the book arrives during an ongoing discussion that the reader may not be fully aware of. We will keep it brief by referring to it as “the inflation, deflation debate.”

In this debate, the two authors come squarely down on the side of an inflationary outcome, based largely on demographics, which they argue will overwhelm whatever contrary forces might appear. While they give fair treatment to both sides, this is not a book of “on the one hand this, on the other that.” We admire that they look at the evidence, weigh the arguments and come to a conclusion.

Their use of demographics is interesting because some writers like Harry Dent, use demographics to argue for deflation.

For many the puzzle has been – why has the sea of money and credit created by central banks and governments over the past 20 years, not led to the kind of price inflation expected? With inflation quiescent in the face of such monetary expansion, political leaders have been emboldened to spend and borrow beyond even the height of WW II financing, all ostensibly in a period of both peace and prosperity.

So bold are the political leaders, that there was a general indifference by both parties to soaring deficits in the most recently concluded election cycle. One side in fact, proposes massive new spending on top of the incredible increases we have already seen in debts and deficits.

If you can spend and borrow to historic excess without the ill effects of inflation, then they assume the world is better off for it. Our leaders think it is about their wise policies. The authors think it is largely favorable demographics that have moderated inflationary tendencies.

This tendency to spend to excess and use the central banks in novel ways to finance it (Quantitative Easing, zero interest rates) has been accelerating since the currency crisis of 1998, through today and the economic wreckage of the pandemic induced Lockdown.

These novel central bank maneuvers started in Japan after their crash of 1989. Now, hyperactive central banking has become standard policy for all major economic systems today. We will call this the Grand Monetary Experiment or GME.

Critics of GME suggest that inflation is indeed present, just in a somewhat different form than what we saw in the 1960-1980 period, which ended with interest rates above 20% and inflation in the range of 12%.

It may be that inflation calculations (hedonic accounting which supposedly adjusts for quality changes) are hiding the inflation from us. Critics contend if calculations were performed the same as in the 1970s, inflation would be quite obvious and the new ways of calculating are misleading us all. This position has its points but is not that convincing.

Others contend inflation is present for sure, but mostly in asset values like stocks, bonds, and real estate and not in the typical basket of consumer goods measured by the CPI. The stupendous valuation (some say gross overvaluation) of these markets, is evident by historical comparison. This argument has more merit.

Either way, critics of the GME are hard-pressed to explain how such monetary expansion can take place without causing greater general inflation than what we have observed. Inflation does not seem to be the problem. Central banks are in fact busy fighting deflation and governments are “stimulating” with fiscal policy as if we were in a serious recession.

Deflationists contend that debt levels have reached an inflection point where the sheer weight of debt depresses economic growth (Rogoff and Reinhart), and that demographic shifts are causing a drop in demand. As the population will be shrinking, so will the demand for goods.

This may explain why money supply numbers have been quiet until quite recently. Now they are up about 25%, year over year.

The main argument of deflationists is that we had a confluence of deflationary events, such as technological improvements on a vast scale (the internet and personal computer), news ways of marketing and distribution (Walmart, Amazon) and entry of new workers previously outside of the general world economy. The integration of China into the world trading system, the fall of the Berlin Wall, and the rise of India have all had the effect of introducing a vast trove of new workers, which have moderated wage rates and lowered the cost of many goods. It has allowed “globalization” and off-shoring of production to low-cost areas of the world.

To give some sense of the immensity of China’s role in deflation, consider this: since 1990, China’s contribution to the growth of the working-age population is four times that of North America and Europe combined.

Globalization brought in not just Chinese workers but from other areas as well. The end result was a huge growth in the supply of labor.

And we have virtually doubled the labor force in the West since the 1970s by the full integration of women.

The combination of all these political, technological and demographic trends, has been to pull prices downward even in the face of monetary expansion. Inflation is not so much a monetary phenomenon as monetarists like Milton Friedman had thought.

So strong are these deflationary undertows, that Central Banks are hard-pressed, even with their extraordinary exertions, to hit and maintain their 2% inflation targets.

Thus, deflationists contend, we are locked in a period of slow growth and high debt which will keep inflation and interest rates low for years to come. This position seems to be the dominant view among economists and money managers.

So, amid this debate comes this new and controversial book.

The authors contend, that this “sweet spot” of the confluence of disinflationary trends is coming to a close and will go in reverse. Thus, rising inflation and rising interest rates lie ahead. They accept the notion that demographics is a prime mover, just like the deflationists. The difference is that they think those forces are now swinging the other way.

It would be hard to overemphasize the importance of what they say because if they are right, the next 30 years will look quite different than the last 30. More importantly, it will create difficulty because the global political leadership is fully convinced of the opposite view.

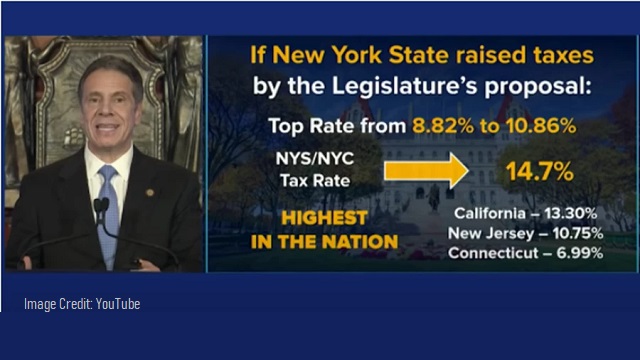

A rise in inflation and interest rates will shock the ruling elites, making governing more difficult. With a rise of just 2% in interest rates, the cost of carrying the U.S. $27 trillion-dollar national debt goes up by almost $600 billion per year. Interest expense and care of the elderly will crowd out other federal expenditures.

Similar costs will hit the private sector, which has gorged itself with low-cost debt.

The author’s key argument is that the number of young workers globally is due to begin shrinking rapidly soon. There is no possibility of experiencing “another China” or another collapse of the Berlin Wall and its powerful downward influence on labor costs. Those forces were unique and are now reversing.

For example, look at China. Because of their one-child policy and likely near the end of the migration from rural areas to urban industrial production, the supply of cheap labor is drying up. That is also occurring in Eastern Europe and Latin America. Only sub-Saharan Africa is showing population growth.

In most of the world, the number of young will shrink drastically while the ranks of the old, especially the very old, will soar.

In their view, the 40-year period where labor was at a disadvantage to capital is ending. Labor will regain its bargaining power just because of the shortage of workers. They believe workers are aware that their compensation must be net of both inflation and taxation and thus wages will spiral upwards. Labor costs are the biggest component of consumer prices.

The authors believe the “savings glut”, or high savings rates in China caused by the lack of a social safety net, will dry up because it will be spent on elder care. A shortage of savings will result and the need to get a return above the rate of inflation will in turn cause real interest rates to reverse and start to rise.

Thus, the world will face rising inflation and interest rates.

Rising interest rates against a global debt bubble exaggerated by zero interest rates could potentially start another financial crisis, with deflationary implications. This is where their argument is the weakest. But they argue demographics will overwhelm other factors and that the only way out of the debt trap we find ourselves in is to inflate it away.

Similar demographics trends exist in the West as well. While not as severe as the results of the prior one-child policy in China, western families are much smaller than they used to be. Some countries like Germany will see drops in population upwards of 40 to 50 percent over the next few decades. To maintain demographic stability, a society needs 2.1 children per family. Many European countries are in the range of 1.3 to 1.5, and the U.S. has decreased to around 1.7.

But it is more than population contraction. It is population ‘skew’ as well.

Just about everywhere, and at roughly the same time, there will be fewer young workers producing and more old dependents consuming (without working). The authors contend the change in the dependency ratio is inflationary.

The authors are concerned as to where the army of caregivers will come from to care for the elderly and argue that such care cannot be “off-shored” and not likely to be farmed out to robots either. It takes extraordinary social skills for strangers to convince someone in a short time period they can be safely bathed for example and it takes social skills to care for people and maintain necessary dignity. Health care by its nature is idiosyncratic and therefore difficult to mechanize.

They show particular concern about the number of elderly over 80 that will rise dramatically because among this population lurks some of the most expensive diseases such as senile dementia and Parkinson’s. The incidence of these conditions rise after the age of 80 and this age group will be the most rapidly growing part of the population. These conditions are very expensive for society to treat and life expectancy is often not shortened.

Globalization will slow, if not reverse. Brexit and the rise of Trumpism are indications that political blowback to off-shoring to the cheapest producer has limitations, and the world supply chain now is looking both at price and political stability. Chinese culpability for Covid-19 and the vulnerability of the West for drugs and personal protective gear, has triggered the realization in the U.S. and Europe that too much of the supply chain is in the hands of either a fierce competitor or an outright adversary. Production will be migrating home or to other safer, more expensive locales.

This is one of those important “Big Picture” books, that looks at big, broad trends and helps one think about them in new ways. While they do a good job of airing both sides of the argument, they conclude with a convincing argument that inflation and higher rates will be the outcome.

The fact that their conclusions are so different from the established consensus today among ruling elites is hardly a reason to dismiss them. Their arguments deserve to be examined on the merits.

The book is not an easy read as it is technical, filled with charts, jargon and citations to numerous studies. But admirably, unlike many academics, they reach a conclusion with important ramifications.

The debate will undoubtedly rage on, but if they are correct, what do policymakers need to do differently? If they are right, what do investors do differently?

In this current period of complex forces colliding without a certain outcome, timing is difficult. The authors could be correct but these inflationary trends might not emerge for several years or appear fleeting before it becomes clear they are persistent. However, in a final postscript to the book covering events around the Wuhan virus and the worldwide lockdowns, they suggest the shift to inflation is much closer than they previously thought.

Lockdown has been a huge hit to production. It is a massive shock to the supply of goods. That is what happens when the government orders people not to work and produce. They conclude that the economic trauma of the lockdown will mark the dividing line between the deflationary factors of the past 30 years, and the resurgent inflation that will replace them in the next 20 years. The shift to inflation is not years away, it is now in the early stage of reversing from deflation.

As an investor, it might be worthwhile to check in on long-term commodity prices, gold prices, wage rates and interest rates. It is hard to see the themes of this book playing out without it becoming evident in markets well before the trend is obvious to the general public. Price action should confirm the theory.

Interestingly, in recent months we are seeing stronger commodity prices, a weaker dollar, rising gold prices, rising wages (particularly minimum wages around the world) and rising interest rates. Only time will tell if these trends are transitory or the start of a new sustained long-term trend.