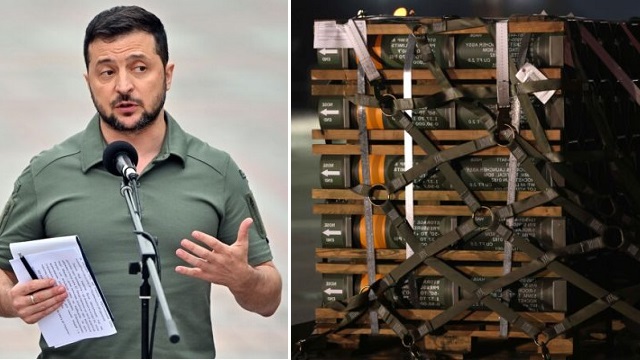

No More $$$ or Warfighting Equipment to Ukraine

By Royal A. Brown III

Zelensky and most of his govt are corrupt oligarchs and our Congress has not done their oversight job regarding all the U.S. assets sent to him. Accountability is non-existent and we should not send anything else unless and until oversight and accountability to the U.S. taxpayers is firmly established and is accurate.

NATO already does not pay its fair share for their defense and continue to depend on the U.S. to contribute the lion’s share. POTUS Trump was right on this and NATO was improving but then went right back to leaning on the US for most of major support for Ukraine. The equally feckless UN has also done nothing. Past time for those most directly affected to pony up their fair share especially since US direct national security is not involved.

The argument that if we don’t stop Russia the Chinese will be further emboldened to invade Taiwan is ludicrous – the feckless Obama 3/Beijing Joe Biden regime no longer scares China and supporting Ukraine won’t make a difference in their actions. There is no doubt the Russian invaders should pull out of the eastern regions of Ukraine they occupy and that Putin would like to see a return to the old Soviet Union power base but continuously poking the Russian Bear is not the way to make them pull out of eastern Ukraine. Zelensky had a chance for peace negotiated by Israel requiring him to stop pushing to join NATO but refused.

The left and RINO neocons are suggesting we provide Ukraine with offensive weapons like long range missiles and F 16 fighter/bombers for use in striking inside Russia and this would surely escalate the war not stop it. The positioning of U.S. boots on the ground in Poland in the form of the 101st Airborne Division is a further provocation. No U.S. military boots should set foot in Ukraine. The failed Obama/Biden administration had an opportunity to show strength against the Russian takeover of Crimea back in early 2014 and did nothing except impose ineffective sanctions. This failure emboldened the Russians. It is doubtful they will ever return mostly pro-Russian Crimea but a peaceful solution could return use of Black Sea ports in Crimea to Ukraine.

I would remind all that every major war since Korea has been started by and prosecuted by Democrats and neocons e.g. Vietnam, Iraq, Afghanistan at a cost of over 64,000 US lives and Trillions of dollars; many tens of thousands of wounded and maimed and ended in failure. Only the war against ISIS in Syria, Iraq and other Islamist countries was successfully conducted by President Trump who also got us out of Iraq and had a plan to get us out of Afghanistan without further loss of U.S. lives, equipment and key air base. The Biden pullout of Afghanistan was an unmitigated disaster. We can not trust the Obama 3/Beijing Joe Biden regime to get us out of the war between Russia and Ukraine.

The article at link below describes some of the corruption going on in Ukraine including information that only 30% of cash and equipment U.S. has sent to Ukraine is actually going where intended to help them fight war with Russia.

Ukraine’s History of Corruption a Growing Concern as US Military Aid Surges

By Admin • Published on March 18, 2023

ince Russia invaded Ukraine on Feb. 24, 2022, the United States has provided Kyiv with military, economic, humanitarian, and other forms of aid.

According to official sources, the total U.S. contribution to the Ukrainian war effort now stands at some $113 billion, vastly exceeding contributions made by Kyiv’s other allies.

But as the bills have continued to mount, so have calls for greater oversight as to how those funds are being spent. Recent corruption scandals in Kyiv have raised fears that U.S. taxpayer dollars are, in the absence of accountability, being squandered.

What’s more, dissident voices are pointing out that the war shows little–if any–sign of ending soon, despite the West’s seemingly boundless support for Ukraine.

Breaking It Down

Responding to questions from The Epoch Times, the Washington-based Committee for a Responsible Federal Budget (CRFB) confirmed that the $113 billion figure was “still accurate.”

This figure, it explained, “includes only the funding packages Congress approved through December 2022, and Congress has not approved any further packages in 2023 thus far.”

According to CRFB data, roughly three-fifths of the $113 billion ($67 billion) has been allocated for “defense needs,” while the remaining two-fifths ($46 billion) has been earmarked for “non-defense concerns.”

More precise breakdowns can appear bewildering, with official and semi-official sources (state agencies, think tanks, media outlets, etc.) often appearing to contradict one another.

“The confusion tends to be in how money is appropriated and spent by the government,” said the CRFB, a nonpartisan group with the stated aim of “educating the public on issues with significant fiscal policy impact.”

Congress, the group explained, “has constitutional authority to decide how much federal spending there should be–the “power of the purse”–while the Executive Branch (the president and other agencies) are charged with spending that money.”

“Depending on when you account for that spending will get you different amounts,” the CRFB added, “because it takes the Executive time to actually spend the money Congress appropriates.”

©Royal A. Brown. All rights reserved.

RELATED ARTICLES:

![Air Force Goes on Diversity, Inclusion, Equity [DIE] Hiring Spree: Top Job Pays up to $183,500 thumbnail](https://drrichswier.com/wp-content/uploads/USAF-DIE-GR.jpg)